Since every year our fast-moving world is becoming increasingly digitized, countering fraud in the e-commerce field has become a crucial issue. Hacker attacks can cause serious financial damage and undermine the reputation of companies. Manually performed compliance processes cannot cope with a great number of such attacks. Therefore, the development of automated compliance as a system with elements of artificial intelligence is very important for protecting enterprises from hacker threats.

My name is Victoria Troshkova, and I’m a specialist of the Partnership department in Utip Technologies Ltd. Company. In this article I’ll tell you about the benefits of the automated compliance system, as well as what points should be fulfilled and which tips should not be neglected when completing this procedure.

What is compliance?

In simple terms, the concept of compliance itself means meeting the requirements. In the brokerage business, this term refers to the process of verifying the client’s identity.

KYC and AML standards are the basis of security in the financial sector

To successfully complete compliance procedures, you must adhere to the KYC and AML policies. These are the standards by which the broker undertakes obligations to combat money laundering and terrorist financing.

The modern financial market stands for complete transparency of transactions and the rejection of anonymous operations. KYC systems collect data into databases to identify clients and risky transactions.

For example, there are solutions based on artificial intelligence that verify identity using an ID photo. They analyze the image based on many parameters and compare the location of the graphs with the original document. This helps to ensure the reliability of the customer base and reduce fraud using other people’s data.

Such systems are important to protect brokers and create a transparent market for services. They automate routine checks and improve security.

The main advantages of KYC process automation

- Reducing time and increasing efficiency. Instead of manual data entry and a lot of paper documents, automated tools allow brokers to collect and analyze information quickly.

- Improving accuracy and reliability. Automation of the KYC process eliminates the possibility of errors associated with manual data entry. Automation systems ensure accurate data matching, which makes it possible to detect potential risks and fraudulent activities.

- Matching to the regulatory requirements. Automated KYC tools help companies comply with regulatory requirements related to customer verification.

- Cost reduction. Automation of the KYC process reduces the cost of manual processing and customer verification.

- Improved customer experience. Сustomers can go through the identification process faster and more conveniently using automated KYC tools.

Automation of inspections through sanctions lists

In recent years, the business has faced new risks, linked with sanctions, counter-sanctions regulation and legislative changes.

Special online tools based on artificial intelligence have been created for quick and reliable check the presence of customer names in the sanctions lists, as well as the names of their relatives and linked persons. The data in such databases is updated regularly.

There are functions for reporting suspicious transactions and verifying documents for authenticity. This helps to identify whether clients have been on the sanctions lists before.

Such tools make customers check for compliance with regulatory requirements easier and faster. Therefore, their automation reduces the risk of errors and simplifies the work of employees.

Сompliance automation is a prerequisite for the brokerage companies development

In 2023, the combating money laundering in the cryptocurrencies reached a new stage of development. The growing popularity of cryptocurrencies forced regulators and governments around the world to pay more attention to this issue.

There are even more opportunities to hide and launder dirty money than before. Cryptocurrency is very convenient for money laundering due to the irreversibility of the transaction, anonymity and uncertain regulation and taxation.

According to DeFiLlama, in 2023, cybercriminals stole about $1 billion from the crypto market. Exchanges such as Binance must exercise increased vigilance and caution due to the enormous pressure on the crypto industry and regulatory compliance requirements.

There are two key tools in the fight against money laundering: transaction monitoring and enhanced due diligence. Automated systems simplify the work process significantly, therefore the integration of such solutions is inevitable for scaling the business of brokerage companies.

Advantages of compliance automation:

- reducing errors, inaccuracies and data loss;

- preventing the financing of terrorism;

- matching with the requirements of the regulator and international law;

- increasing trust due to the high level of reliability and legality of the platform;

- reducing time for processing documents.

When is compliance automation really necessary?

Often, for small businesses, the automated compliance system implementation may lead to the unpleasant financial effect, so it is not worth it.

The main task of compliance is to make it effective, and not just exist on paper, or moreover, overload the business with unnecessary control and additional costs.

Automated compliance is really necessary for brokerage companies if:

- Broker has dozens, hundreds, or even thousands of clients that it cannot check manually.

- The company does not have enough employees and needs to automate the counterparty verification process. The automated compliance system will allow monitoring clients on an automatic basis: as soon as the information is updated in the counterparty’s profile, a corresponding notification will be sent.

- The company is already using manual compliance methods, but planning to scale up in the future. In this case, the transition from manual compliance procedures to the automotive version will be economically beneficial. Very often, companies turn a blind eye to losses from inefficient manual compliance or act blindly, being completely uninformed of auto-compliance financial benefit.

Tips that will help you choose a technical solution for a brokerage site:

Evaluate your capabilities in advance. Highlight the main company priorities and policy, for complying with legal requirements, and study the rules for maintaining customer data.

Carefully study the requirements. Study all requirements and be ready to provide all the necessary documentation.

Contact the professionals. Connect with the specialists of Utip Technologies Ltd. to get all additional information and assistance in choosing a supplier for automated compliance system implementation. Our staff will introduce you to our partners, who will assist with simplifying the process, and advising you at every stage.

Following the advice will help you to build a reliable compliance process and reduce reputational risks. Furthermore it will make the work with international contractors easier, since the presence of policies and the organization of a compliance process corresponding to the world’s leading practices is an increasingly common requirement for the establishing partnerships.If you would like to receive more detailed information about the auto compliance system and its integration, please leave a request on our website. Technical questions may take enough time that brokers might be able to use them to solve more important issues. That’s why we are always ready to help clients to reduce their time costs. The managers of the Partner Department of Utip Technologies Ltd. will redirect you to our trusted and qualified partners. They are ready to assist you and provide all necessary information.

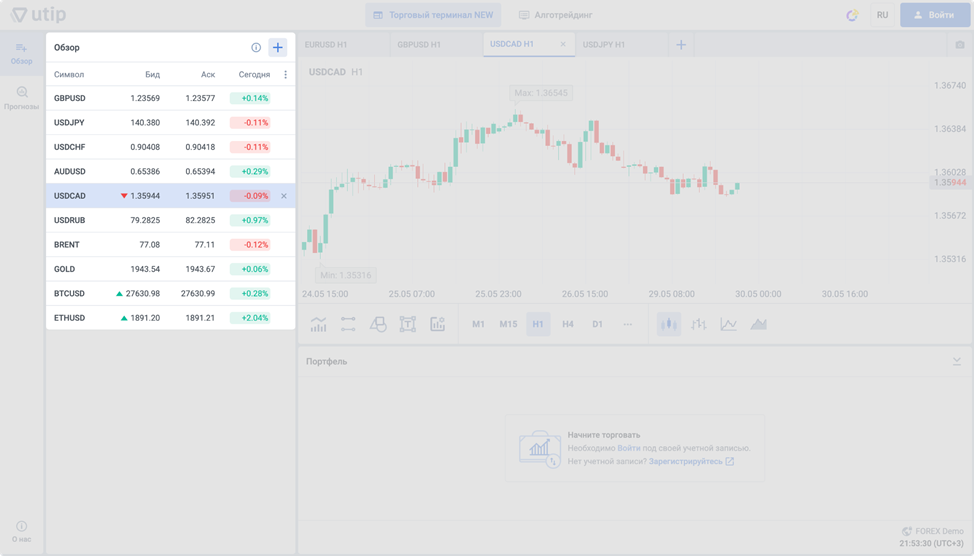

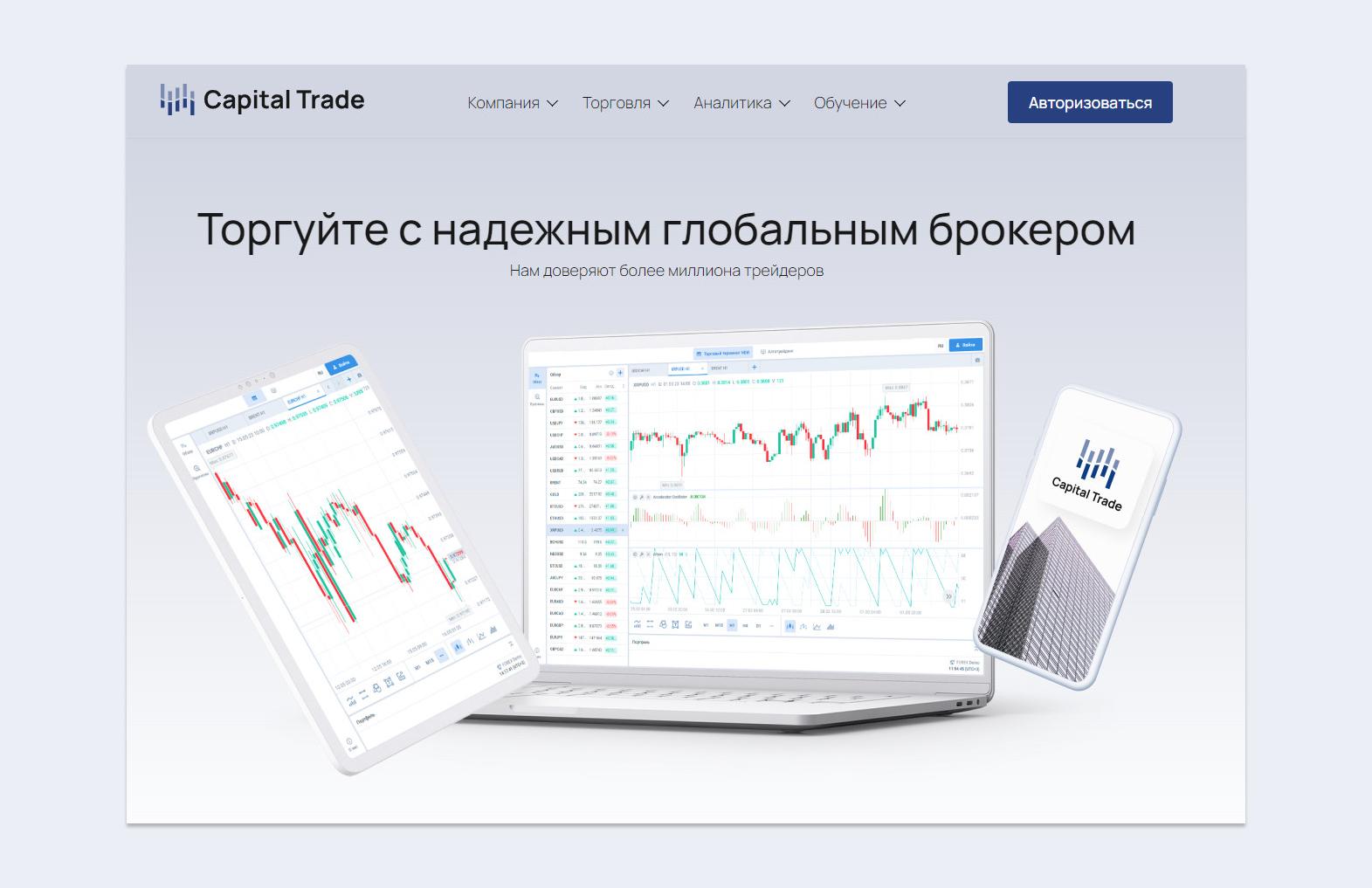

Understanding how the forex market works and knowing the needs of traders is important when creating a forex website that attracts clients. In addition to a user-friendly and fast website, your clients want to get up-to-date information about the market and tools for analysis.

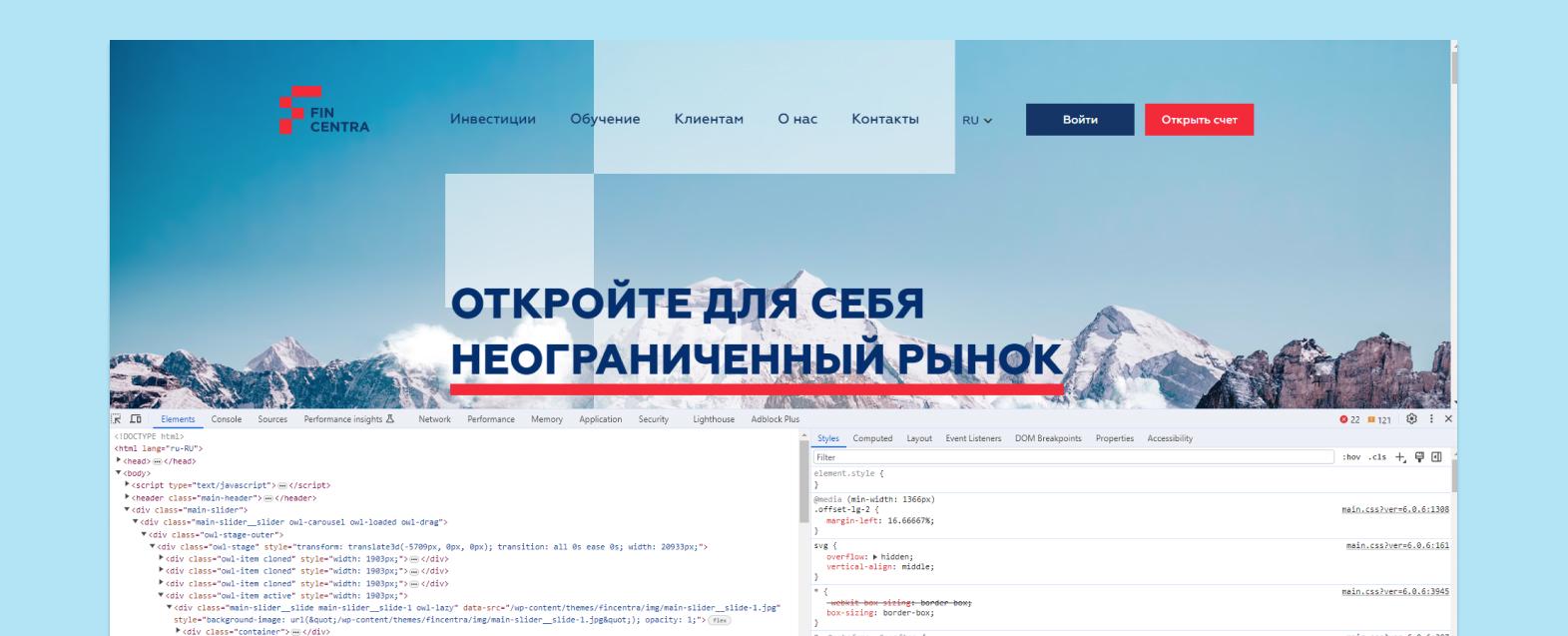

I’m Alexander Shvorak, and I have been creating websites at UTIP Technologies Ltd. for more than 5 years. I am going to tell you in detail what a broker needs to know before proceeding with the forex website development.

1. Website type

What kind of website do you need: a landing page or a multipage website? A landing page contains a limited amount of content, and it will fit brokerage companies that need to launch a forex business as soon as possible. A multipage website features numerous pages and a more complex design. This type of website is necessary for a large forex broker that positions itself as an expert in the financial markets.

The multipage website development costs two or three times as much as a landing page. However, such a website evokes more trust among traders because it contains more useful tools for trading.

2. Understanding the forex market

Before you start creating a forex website, your development team needs to have a good understanding of how the forex market works. You need this in order to design the website of a professional broker, an expert in the financial markets.

For example, if your copywriter knows which assets are popular among traders, he or she will be able to come up with the content that motivates potential clients to go invest in currencies and stocks that are in demand in the market.

Moreover, the knowledge of the forex market is needed to provide clients with quality and useful tools for trading: market analytics, training, background information on the trading platform, market forecasts, financial news, etc.

Developers with no previous experience can create a forex website by copying ideas from the websites of big forex brokers, but only professionals can make these ideas work and make the brokerage company get more leads.

3. Target audience

What kind of traders do you want to attract to the website? They could be novices, experienced traders, scalpers, day traders, crypto traders, algo traders, options traders, and others.

By determining your target audience, you will be able to develop an effective forex website that will attract customers from a specific group.

For example, novices need educational content, while experienced traders are looking for quick access to market analytics.

Besides that, understanding your target audience will allow you to increase conversion on your website and reduce advertising costs. For example, if your brokerage website is aimed at crypto traders or algo traders, the effect of targeted social media advertising will be stronger in comparison to the effect of a website dedicated to classic forex trading.

4. Forex website design

There are different styles of website design, including classic, minimalistic, flat design, card design, brutalist, skeuomorphism, materialism, and others. For a forex website, minimalist design is the most suitable. It is characterized by the absence of unnecessary elements and the emphasis on technology.

A minimalist website is easy to use, and it also adds to the feeling of trust and confidence. This is important for clients who entrust their money to a broker and need quick access to information about their trades.

5. Mobile version of the website

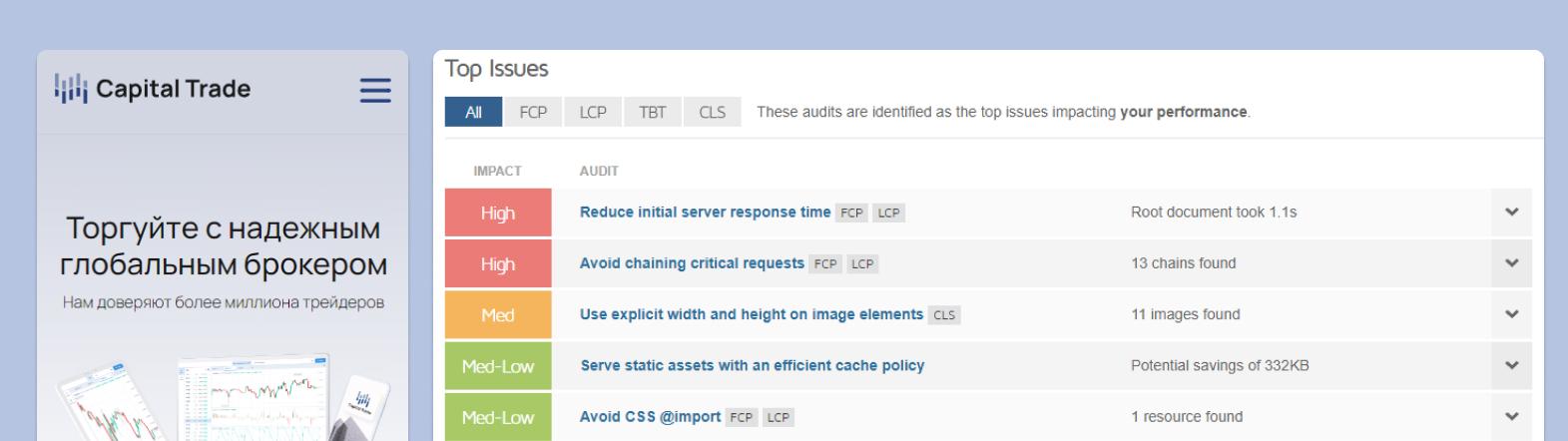

According to a recent Statista research, about 58.33% of the global web traffic comes from mobile devices. This means that if you don’t have a mobile version of your website, you could lose up to half of your potential customers who use mobile devices.

A mobile version of your website has to be fast to load on smartphones, tablets, and widescreen devices. Therefore, your forex website developers should optimize the loading speed of images, JavaScript, CSS, and use caching.

6. Analytics for traders

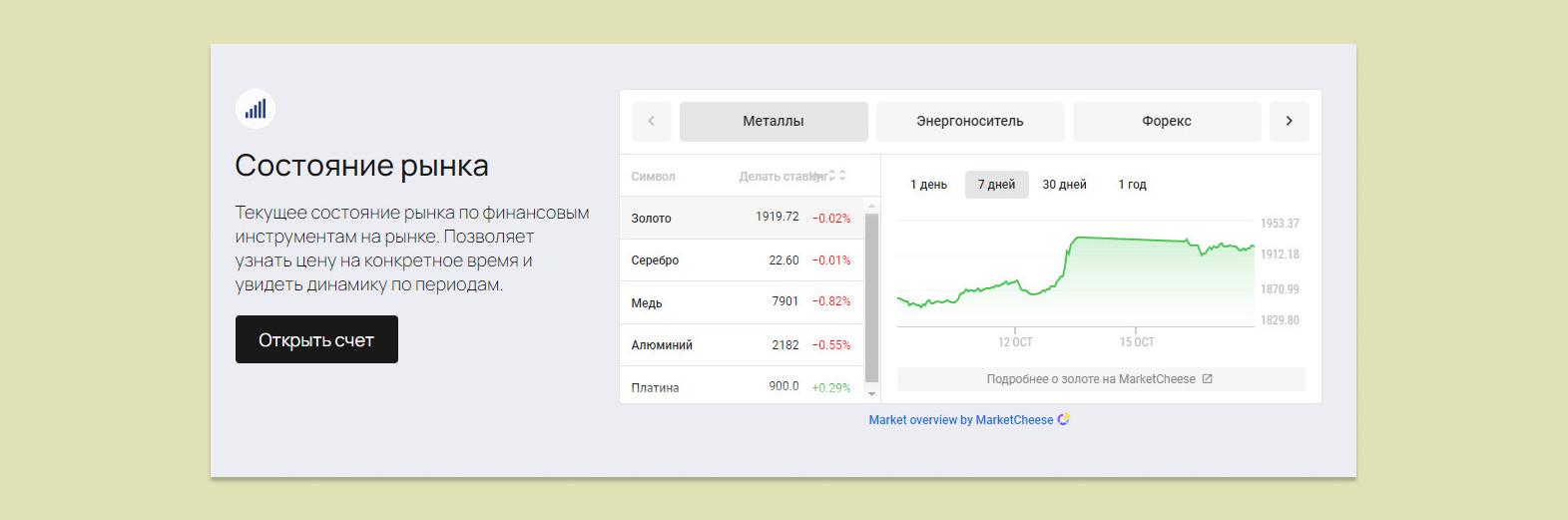

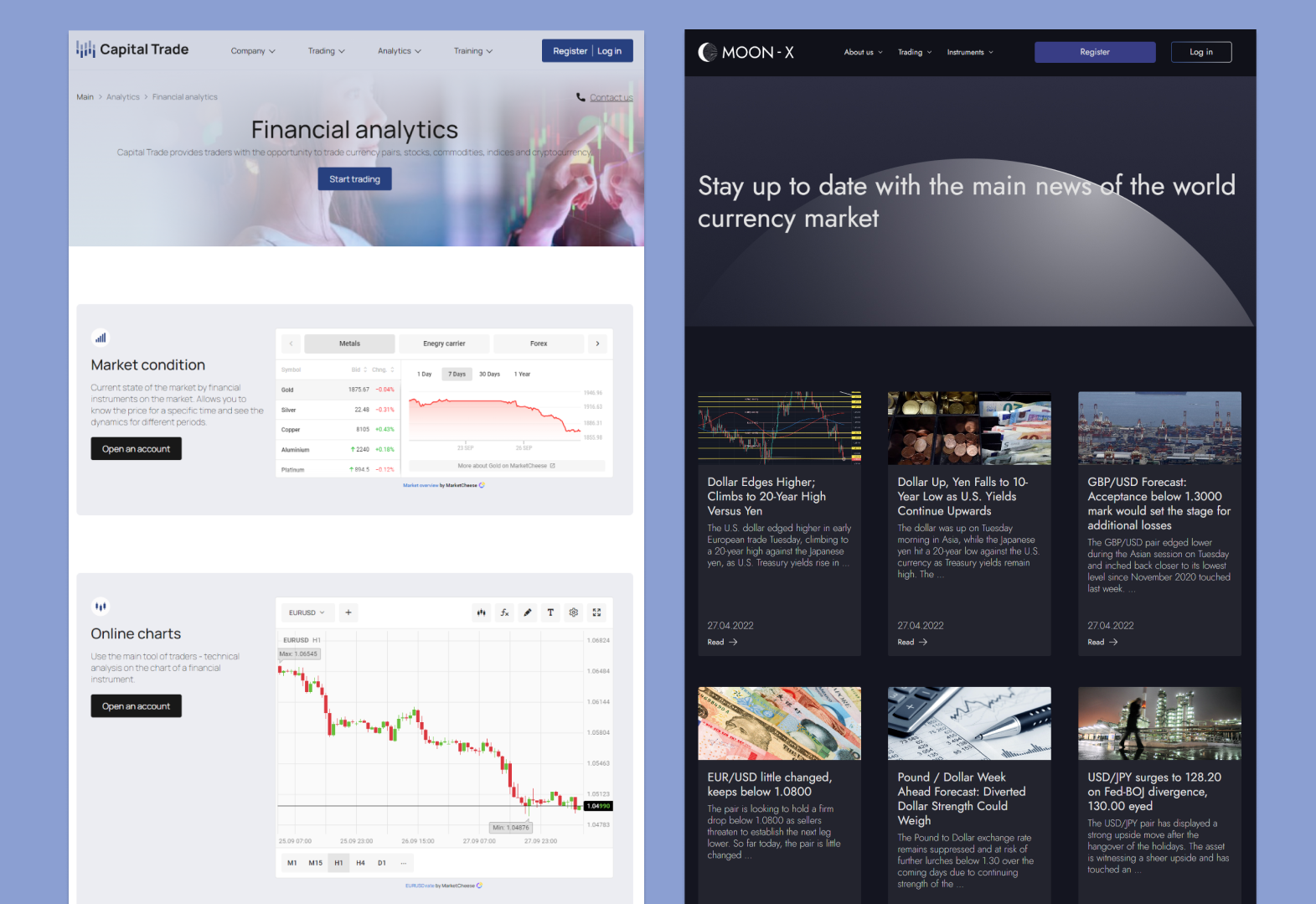

The analytics on a forex broker’s website includes such sections as financial news, expert traders’ forecasts, market overview, currency and stock quotes, price charts of financial assets, etc.

Traders need analytics to know the current state of the market, predict its dynamics and make grounded decisions regarding the purchase or sale of financial assets via the trading platform. In turn, traders who get access to quality analytics tend to have more trust in their broker and maintain a partnership for a longer period of time.

7. Website testing

For a successful launching of a forex website that can attract customers, it’s important to test all features beforehand. Testing will allow you to identify and fix problems early in the development, saving you time and money. Potential clients should not run into errors on the website, such as failing to access the company profile or not being able to download the trader’s terminal by clicking on a button. This can lead to a decrease in the number of registrations to the trading platform.

Conclusion

Development of a forex website is a complex and time-consuming process that requires careful planning, deep understanding of the forex market and clients’ needs from a broker. For this reason, UTIP Technologies Ltd. is ready to share its experience in developing forex projects. Contact your UTIP manager to see some of the examples of forex websites we have created.

Everyone is looking to succeed and extend their business. But exponential growth requires constant innovations, both technological and commercial. Pioneer companies push the boundaries of their infrastructure and promote their opportunities on a regular basis, especially when it comes to payment acceptance solutions. This allows them to enter new markets and strengthen business resilience to crises.

My name is Ivan Noskov, and I’m a senior manager of the Partnership Department at UTIP Technologies Ltd. In this article, I will describe how to use multiple payment gateways in the brokerage business and turn your company into a flexible and trusted groundbreaker, with its unique set of tools for shaping the optimal market geography.

Reputation of the Broker

Outstanding customer service is one of the major factors contributing to the company’s growth. Not only does it help to retain the existing client base, but also to attract new customers, even if the product itself does not stand out among its peers.

Payment acceptance is a fundamental facet of customer service for a business. Rejected transactions and delays in payment processing can bring the firm into disrepute. Wasted time and lost credibility isn’t worth the risk.

Therefore, you need to minimize transaction failures, reduce payment delays, and offer the most convenient payment methods to your customers. It is very hard to accomplish with a single payment system.

3 reasons to connect multiple payment processors

Companies connect multiple payment providers to strengthen their infrastructure and avoid potential pitfalls. But there are other primary causes to plug in more than one payment solution.

Reason №1. It is clear that having at least two systems is essential when extending your business, particularly abroad. Support level is totally different when it comes to international operations. Some providers may claim to support an entire country, but in reality only separate payment methods and currencies are taken into account. Or their ability to process payments in the region is less compelling. Thus, multiple systems should be integrated to carry out transactions within the gateway that best supports a specific region. The success rate of completed operations is higher when you keep in mind the mentioned advice.

Reason №2. Another common scenario is technical problems on the acquirer’s side. If the system goes down, you can lose the loyalty of your customers, not to mention profits. In this case, multiple payment solutions allow the client to quickly redirect the transaction to an alternate gateway.

Reason №3. A merchant has huge transaction volumes, for example, by selling currency at the right time. Businesses that have similar “bursts” need alternatives if a gateway can’t handle the load, but their sales should proceed smoothly. This helps to prevent the merchant from incurring losses.

Increased profit and flexibility

By adding support for multiple payment systems, you can avoid dependency on a single provider. Choose the best solutions for your business and offer the most cost-effective payment options, where the benefits are maximized for both you and your clients.

Instead of automatically relying on one payment processor, brokers should analyze the needs of their business. Fast-growing companies are required to assess the flexibility of their business model and the acceptable number of delays and successful transactions. If these metrics are prioritized, a balanced portfolio of multiple payment gateways can boost their profits and strengthen market positions.

Need to know more about connecting to Payment Gateways? Do not hesitate to submit a request to our experts at UTIP Technologies Ltd.

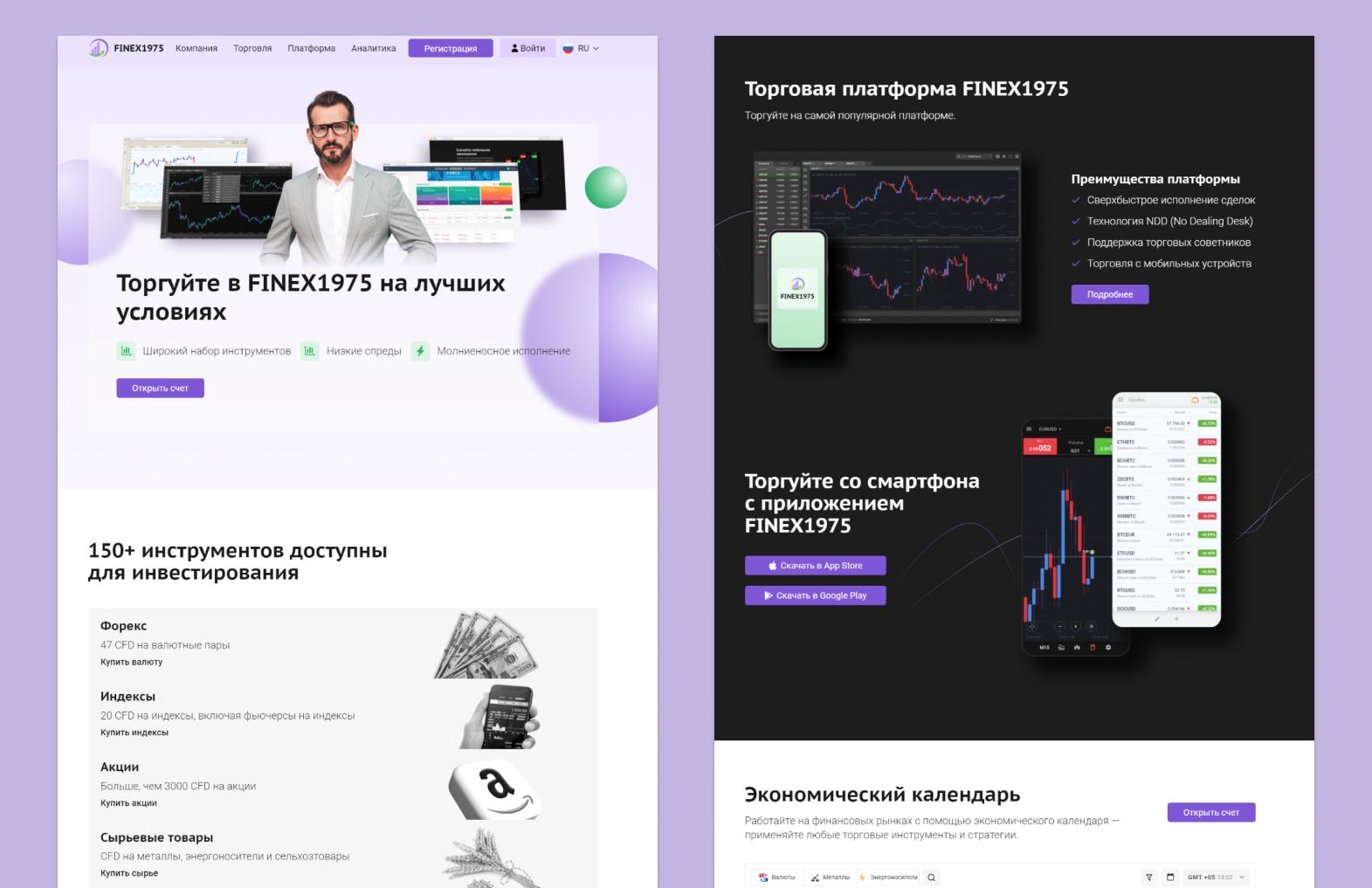

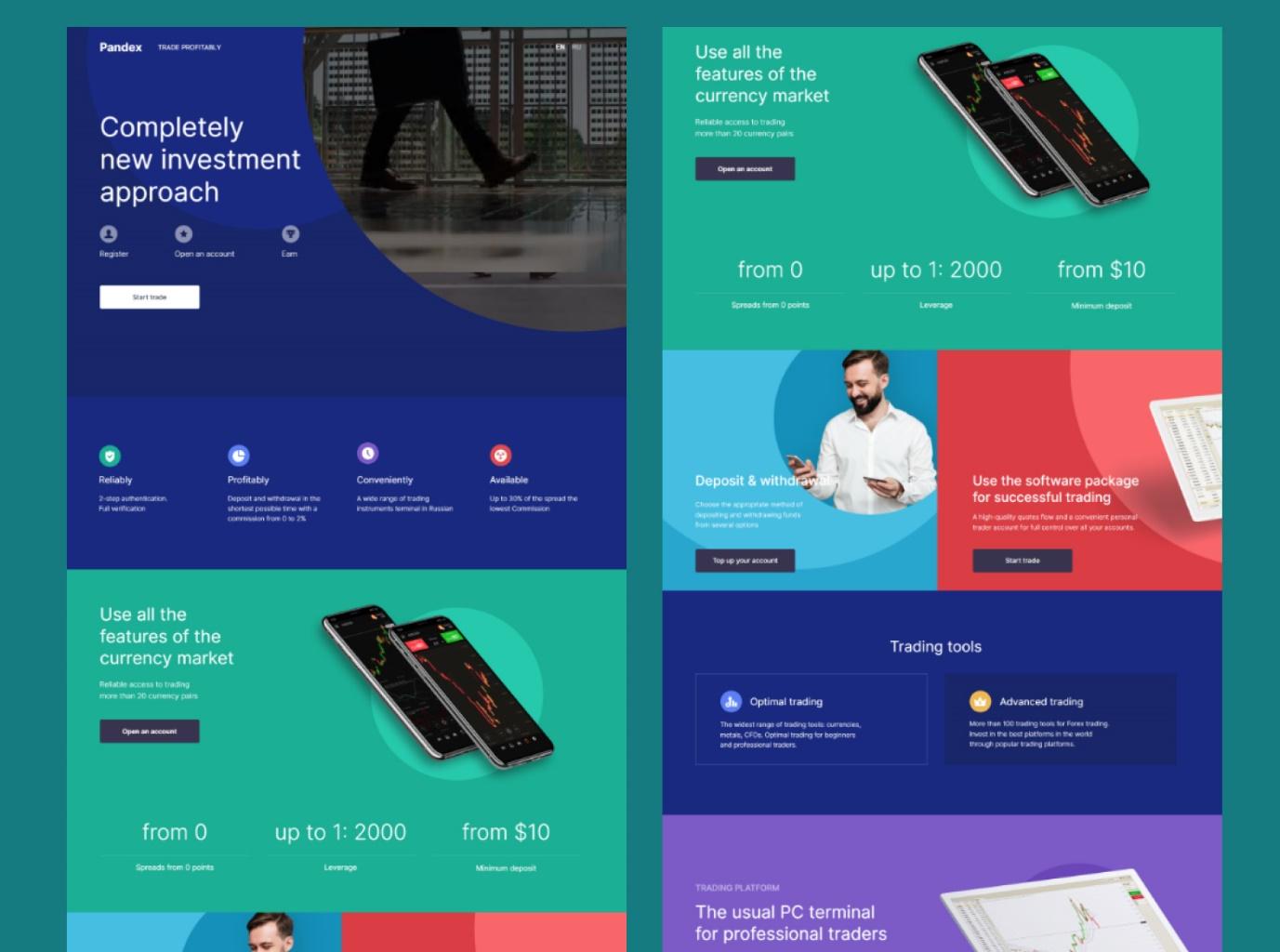

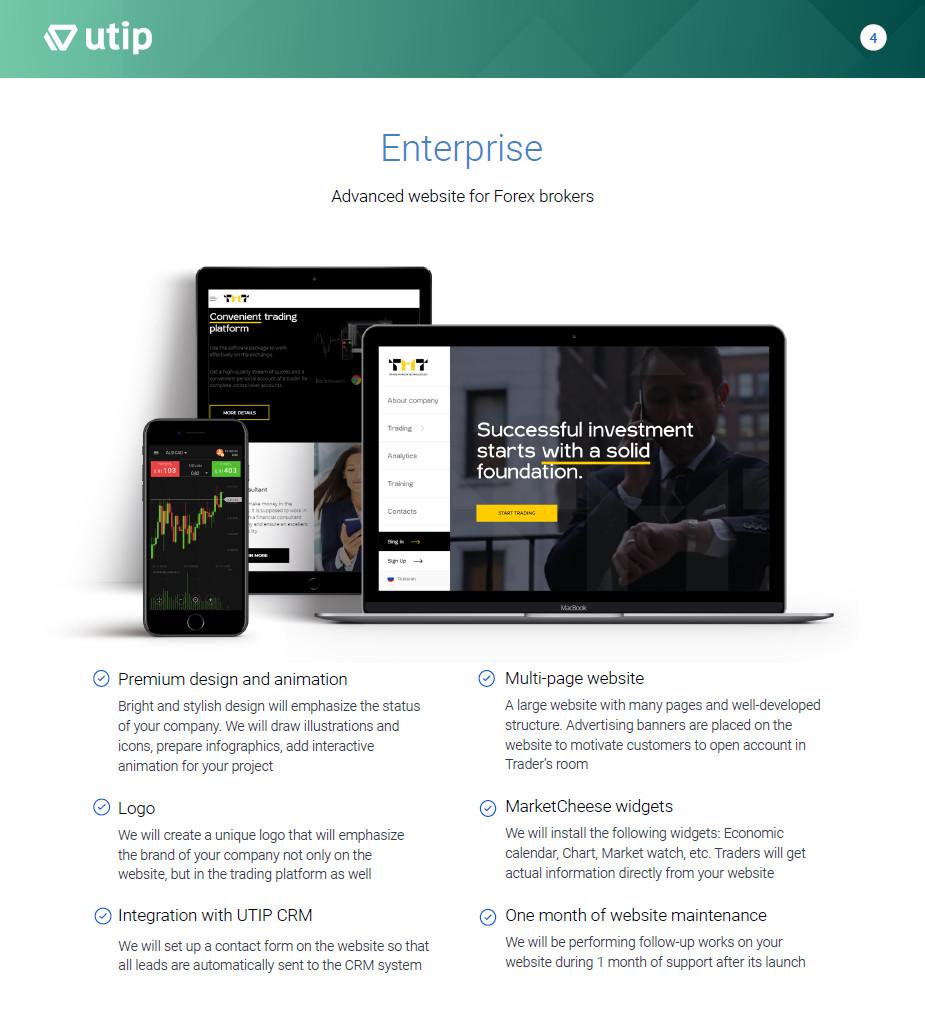

Short answer: Landing page is a good solution for companies that seek to quickly get started with forex business being on a tight budget. A corporate website is mainly suitable for large forex brokerage businesses.

Landing page costs 2 or 3 times cheaper than the website development. However, traders trust a large premium-designed brokerage profile to a much greater degree.

My name is Alexander Shvorak, and I’ve been dealing with the website development in the UTIP Technologies Ltd. over 5 years. In the present article, I will elaborate on lucrative website ideas to be chosen for forex broker.

Loss and gain of Forex Landing page

Plus points Landing pages contain the most important information for traders:

— a list of symbols (“what will I trade?»);

— analytics (“what events should I keep up with to trade?»);

— contacts (“I can’t open an account, who will help me?»);

— broker’s documents (“you can trust a broker with a license!”).

Landing page serves as a mini-supermarket where the information about brokerage company and tools made to facilitate trading activities, are available to the trader. Keeping the content on each mini-section short and precise provides valuable insights to the client.

One page presents information about the broker, trading conditions and the platform itself by making it easier to achieve forex business goals via landing. As an example, to register trading account and scrape contact details of potential customers.

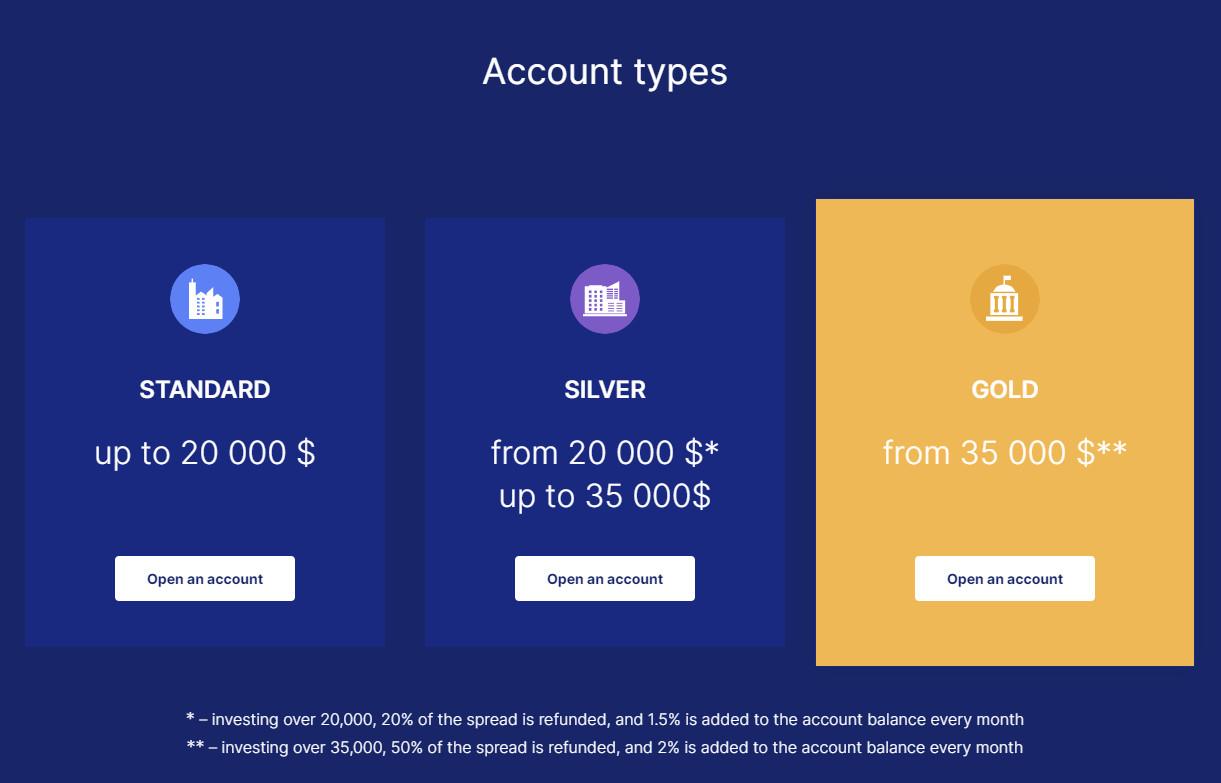

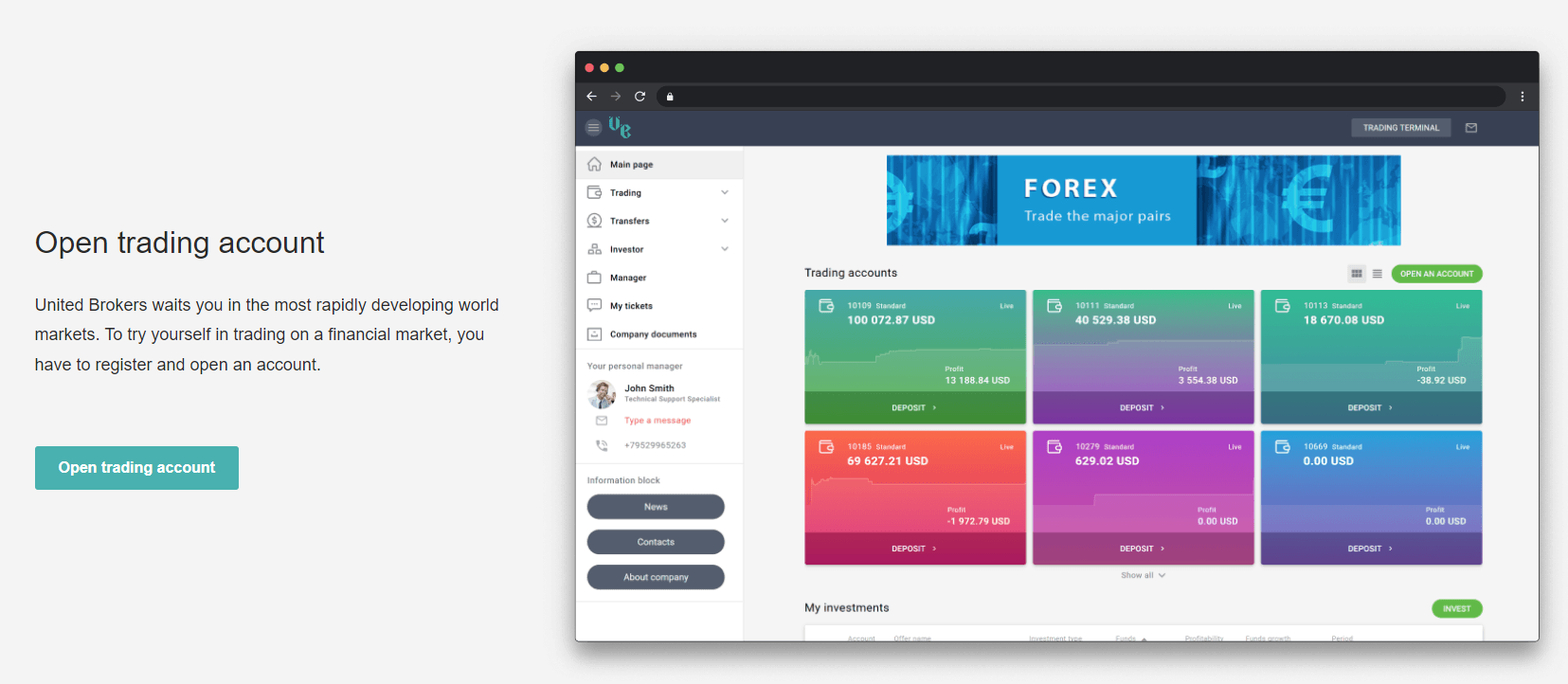

This is how the list of account types in the landing page looks like, i.e. a minimalist design, the website visitor clicks “Open an account” and goes to the Trader’s Room to register and open an account:

Forex landing page development costs from $1500 to $3500 and takes from a few days to a month.

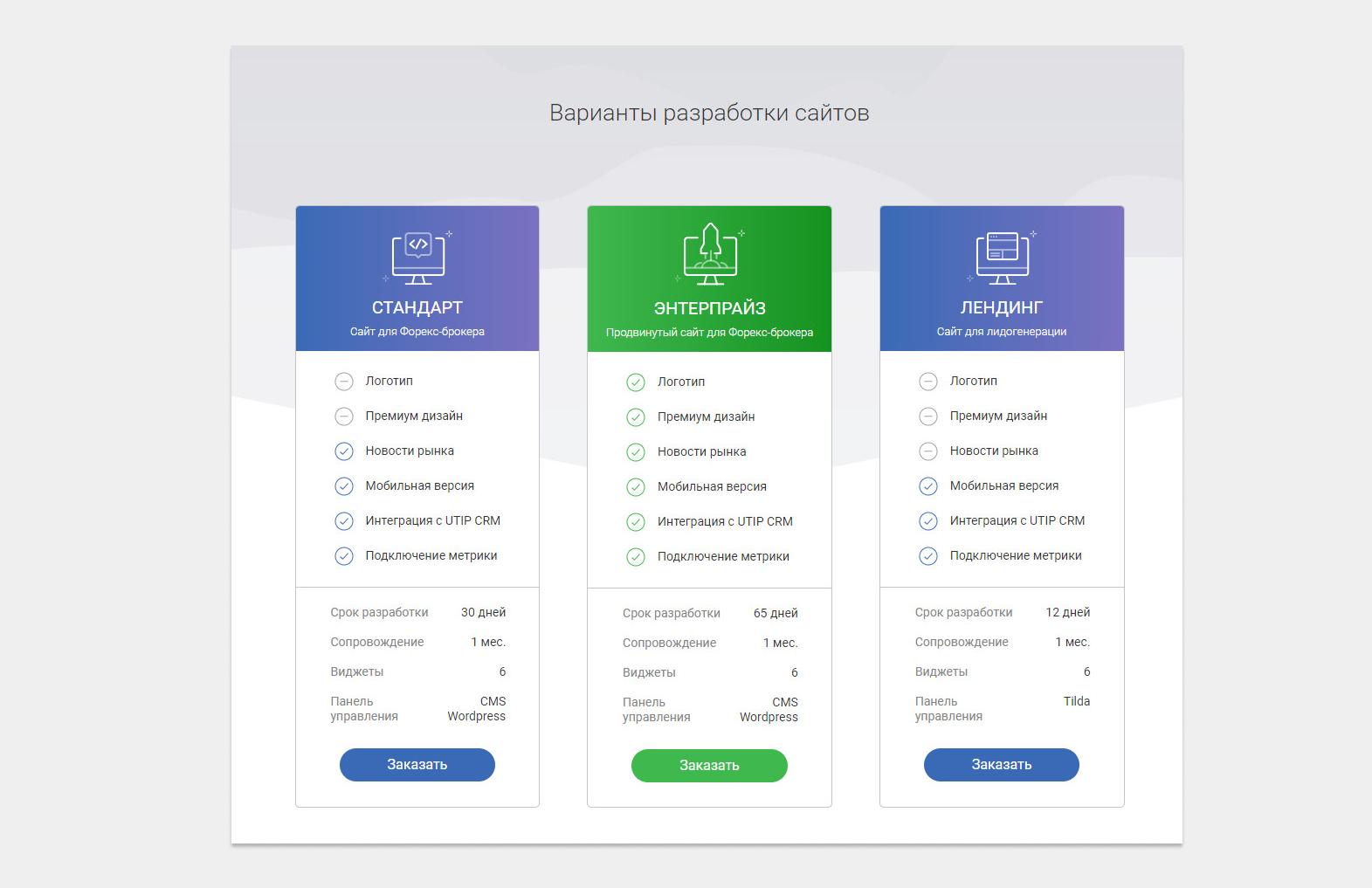

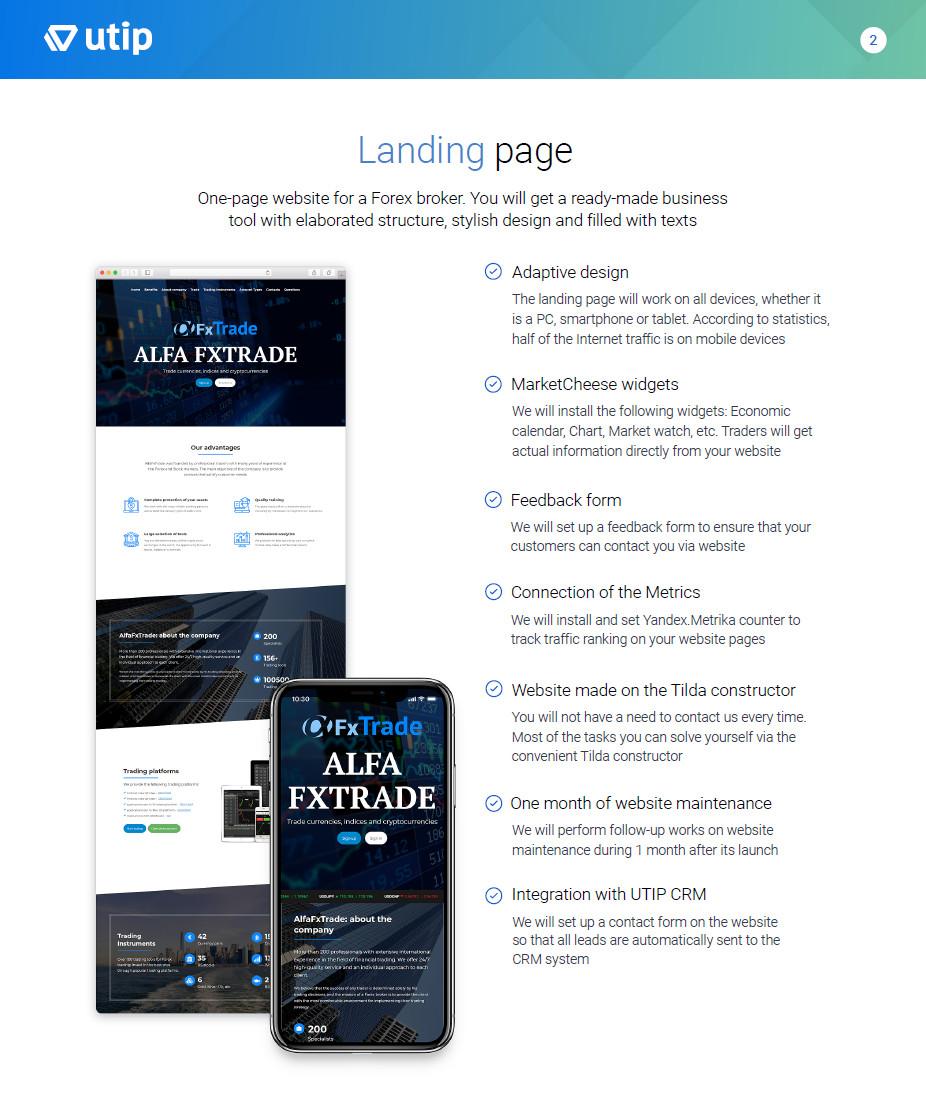

UTIP Technologies Ltd. develops landing pages in just 2 weeks and provides a month free support. Have a look at the standard forex landing development package:

Shortcomings of Landing page:

- The landing page is limited by the content volume. It contains detailed information about the brokerage firm and its trading opportunities.

- The landing page is of a limited functionality and is mainly created for the sole purpose: account registration or collection of contacts. Therefore, it gives away the bit of information about trading, i.e. about company news, a tutorial blog or section for traders.

- Due to content limitations the landing page is quite difficult to promote in search engines.

Loss and gain of the forex corporate website

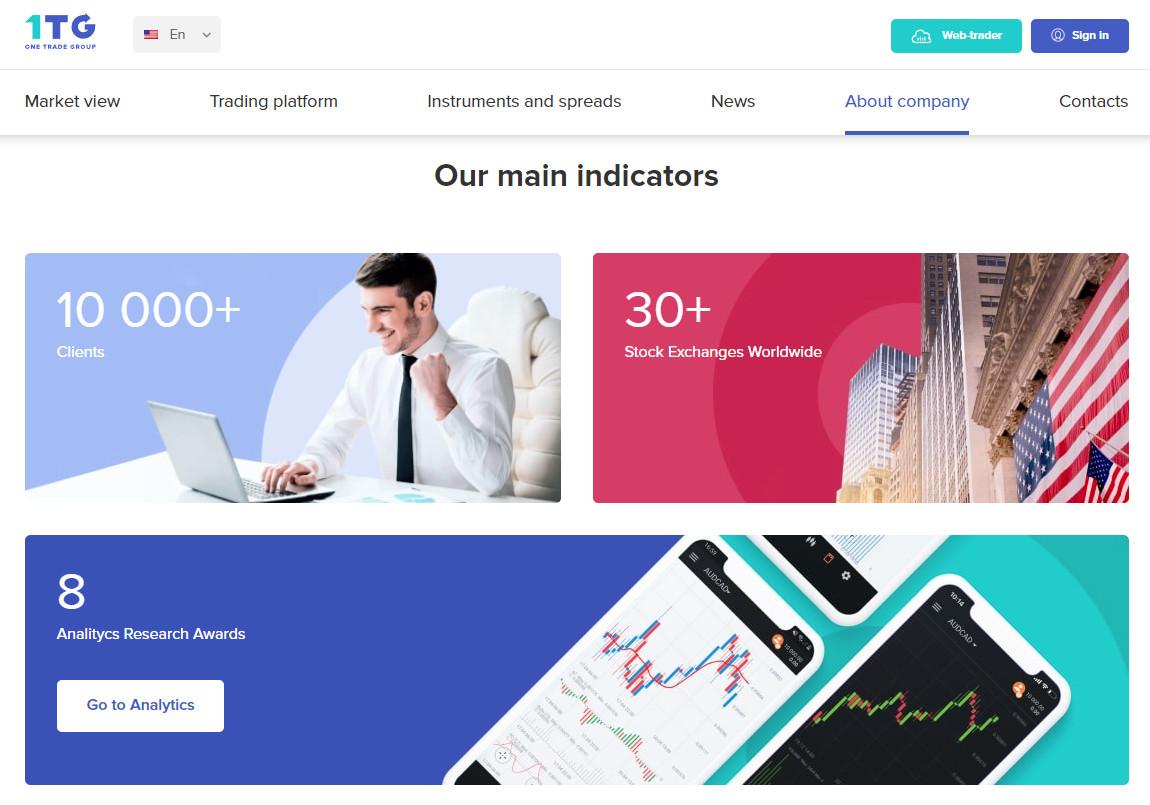

Plus points A multi-page website helps to form a broker’s brand on the Net. On the one hand, the corporate website development is money-and-time-consuming. On the other hand, it attracts more attention of traders because of cutting-edge functionality and more detailed information about the brokerage company.

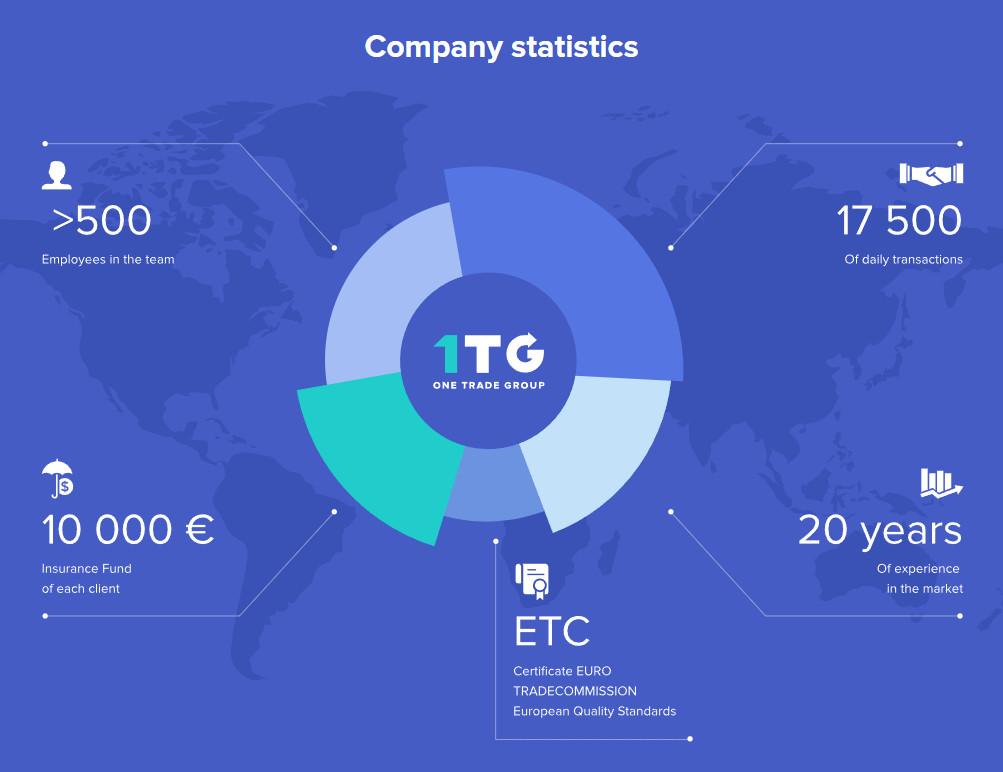

The website provides a full content, so that the broker acquires the opportunity to set a high-quality infographic: for example, sharing the company’s achievements in the Forex market. All in all, it fortifies the brand credibility.

Visual appeal of the large websites ensures the stability and reliability from the online users’ end. They rely on the companies with a full-fledged website.

The multi-page forex website contains advanced trading analytics that makes the website visitors confide in the brokerage expertise, and distinguish it from usual trading resource.

The corporate website can serve as a launching ground for placing the following sections: market news, analyst forecasts, the current market state and tutorials.

The broker is able to set a feedback form, online-chat, a pop-up window with the platform advertising and other online tools that increase the number of incoming customer requests to the brokerage firm. Accordingly, the broker boosts the conversion of leads, registrations and deposits.

UTIP integrates the UTIP CRM into every contact form on the website:

Corporate websites allow brokers to get free targeted traffic from Google and other search engines.

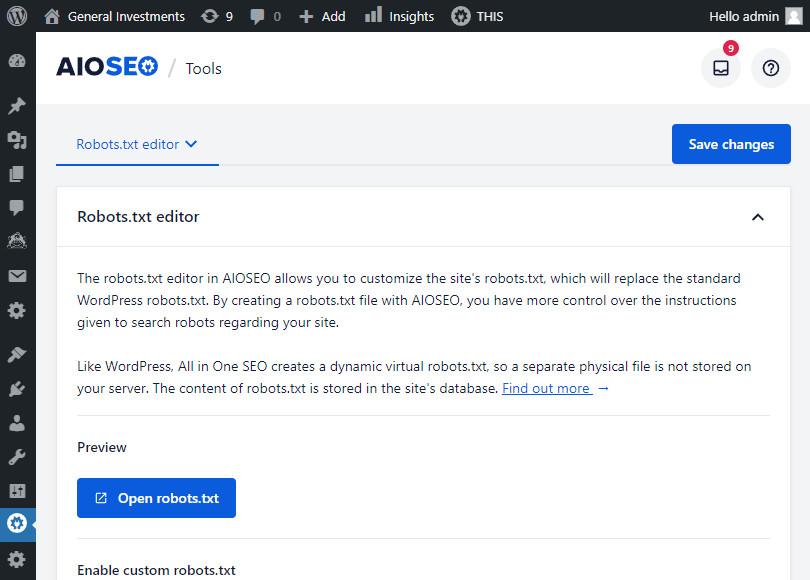

UTIP creates corporate websites for brokers on the CMS WordPress platform (47% of the WordPress websites worldwide), this allows us to carry out the initial SEO of the website content in a short time.

Forex corporate website development costs from $4000 to $20 000 and takes 3-6 months. The list of website development projects includes content creation, multiple page layouts, service integration, testing etc.

UTIP offers best sophisticated website ideas for Forex brokers, embodies them within 65 working days and further renders a month free support.

Tariff plan:

Shortcomings. Corporate website development is time-and-money-consuming in comparison with landing pages. Website maintenance is money-gobbling.

Summary

The choice between a corporate website and a landing page depends on the specific aims and budget that the brokerage company have. Large websites are always created for a long run. They cater for supporting the company’s brand on the Net over the years, whereas a landing page is more focused on a short-term advertising campaign.

Need more information? Do not hesitate to submit a request to our experts from the website development department of UTIP Technologies Ltd.

Integrating a payment system for receiving funds from traders is a key point of operating as a forex broker. And in order to integrate a particular payment system, it is necessary to go through a process of compliance.

I am Ivan Noskov, a lead partnership specialist at UTIP Technologies Ltd. In this article, I would like to explain the concept of compliance, how a broker should prepare for this process, and the main issues that must be taken into account.

What is Compliance

Compliance is conforming to the requirements of payment systems, acquiring banks, or other regulators.

A payment platform is a set of rules, processes and equipment that enables the cash flow. It is also designed to provide clients with a comfortable environment for funding their accounts. A broker needs to go through a compliance process in order to be able to use it. It should be noted that different payment systems may have varying requirements and willingness to cooperate with forex brokers. Some platforms allow working with individuals without the necessity to register a legal entity. Others require a license.

In addition, there are platforms that accept to cooperate with brokers without a license, but require certain legal components. Those components might include having a registered company, Legal Opinion document, bank account, website, verification of a director’s identity by database, and others.

The differences between regions and their compliance requirements were discussed in our previous article.

We further explore three key elements for the compliance procedure:

- a legal basis of the company;

- a website, and a platform availability;

- a CEO of the company.

Required legal framework

To enter into a contract with a payment system, a forex broker’s legal background must include a registered legal entity. Basically, it includes an unregulated (offshore) jurisdiction, such as the Marshall Islands or the Seychelles. The mentioned jurisdictions are favored by brokers, and most payment systems are willing to work with such companies.

If you want to accept payments from Europe or South America, payment system providers may require obtaining a Legal Opinion document for your offshore company. Therefore, you should ensure obtaining this document in advance if you plan to work with traders from a wide range of countries.

The UTIP’s partnership network will assist in preparing a legal background for your brand.

Website preparation

Your website should feature several important policies on the homepage:

- Client Agreement — a public offer containing the terms of cooperation;

- AML and KYC Policy — standards regulating the brokerage company’s obligations to combat money laundering and terrorism financing;

- Refund Policy — a document listing the terms and conditions for refunding a client’s payments;

- Risk Disclosure — a document disclosing information on risks associated with trading activities on financial markets.

To comply with the requirements, you need to have a trading platform and a signup page for traders. This will confirm your activity as a forex broker, and the payment system provider will recognize what type of payment they are to process.

You should also have a checkbox on the signup page to confirm that the user is of legal age and accepts the client agreement and the privacy policy.

Director Verification

Verification of the company’s director or another executive officer is the final step in the process of compliance. Verification can be performed both offline and online.

Offline verification means checking the director’s personal documents, such as passport or ID, and confirming the residence address. A bank statement or a utility bill can serve as proof of address.

Online verification is a separate video confirmation done via a special link from the payment system provider. The director must show their ID through the webcam. It is important for the director to be in contact with the representatives of the payment system from the beginning to the end of the compliance check. Additional requirements may appear during the process.

Tips on preparing to a process of compliance

We hope our tips will help you deal with payment system providers in the future.

Prepare in advance. Assess your capabilities and means of accepting payments. Make sure it meets all the requirements of the payment system provider. Fix any identified flaws before you start the process of compliance.

Seek expert advice. Get in touch with experienced professionals at UTIP Technologies Ltd. for consultation and assistance during the process of compliance. We know how to make it easier for you and will guide you through every step of the procedure. Leave an application form on our website.

Remember that compliance with regulatory requirements and standards is the key to your success and stability in the forex industry.

“20% of customer service is being nice to people, and 80% is devising systems that allow you to do the job right the first time.”

“Customers for life” by Carl Sewell

Hi, my name is Alexander Soloviev, and I am a product manager at UTIP Technologies Ltd. Our company is dedicated to developing software solutions that make working on the financial markets more efficient.

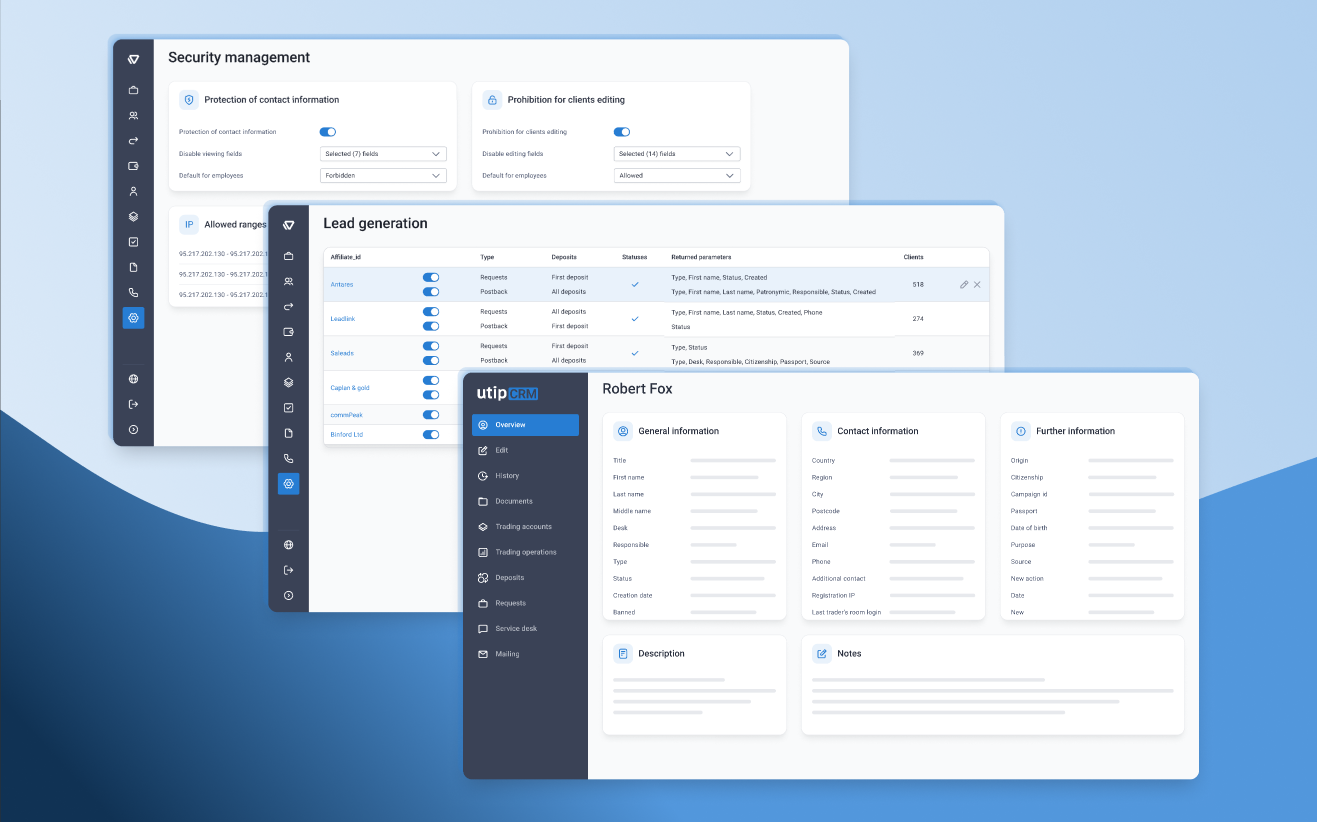

In this article, I’ll show you how to interact with leads in the UTIP CRM. The process of their generation and management in a brokerage firm is also considered in detail.

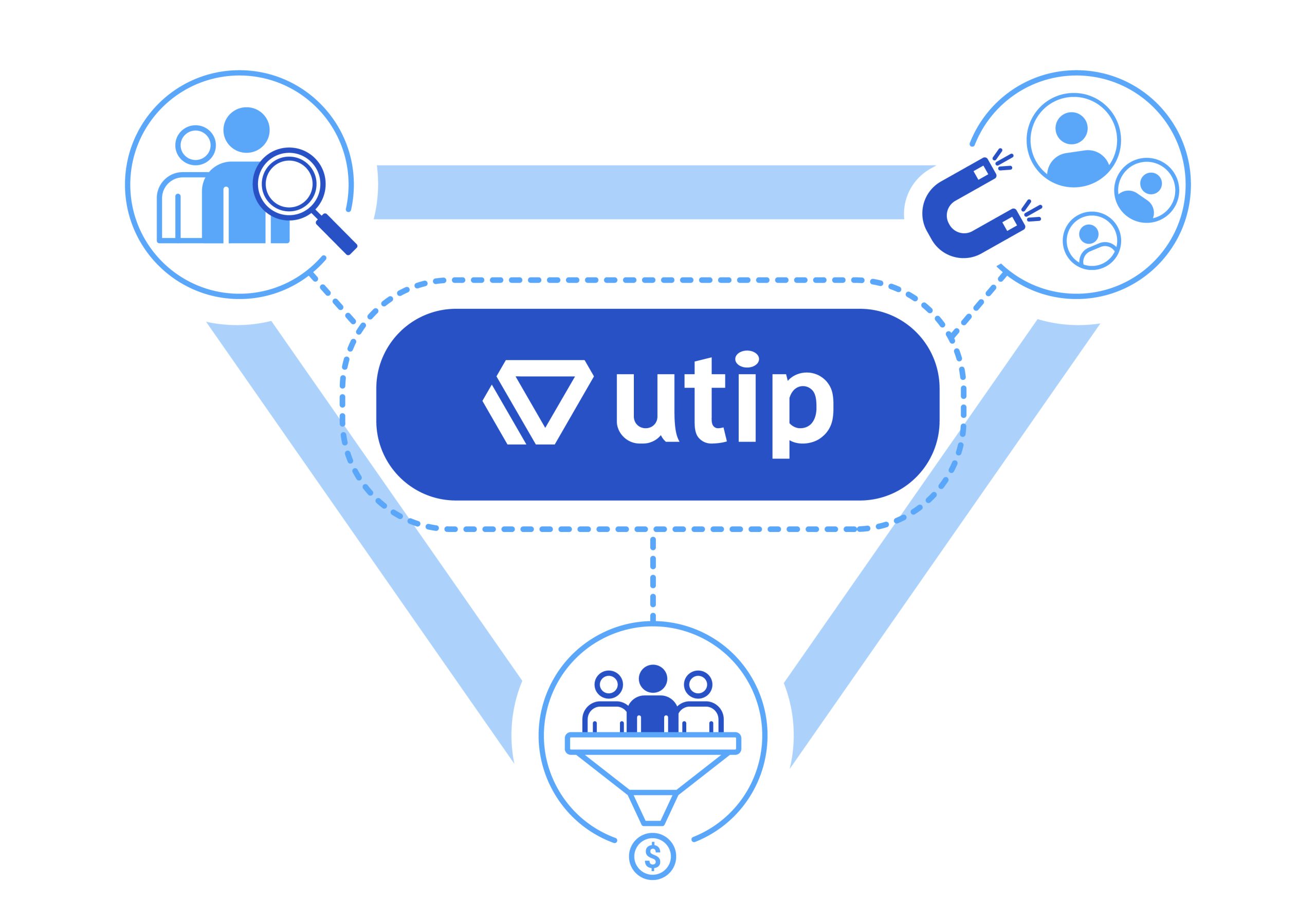

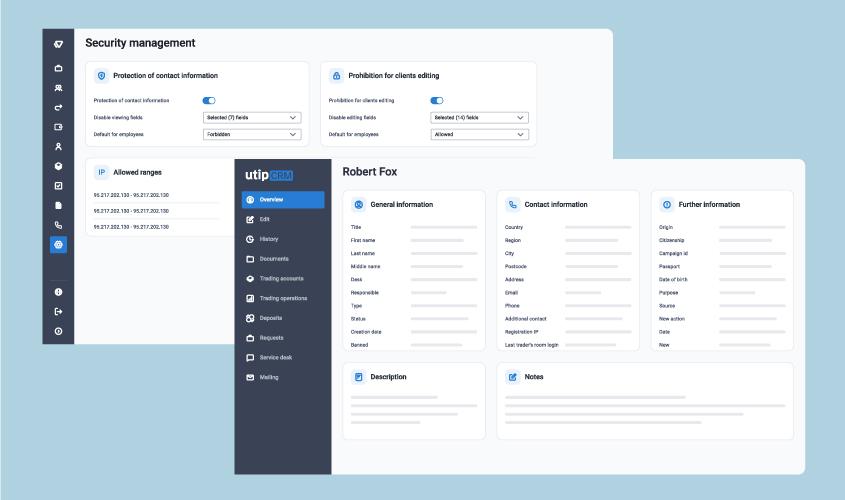

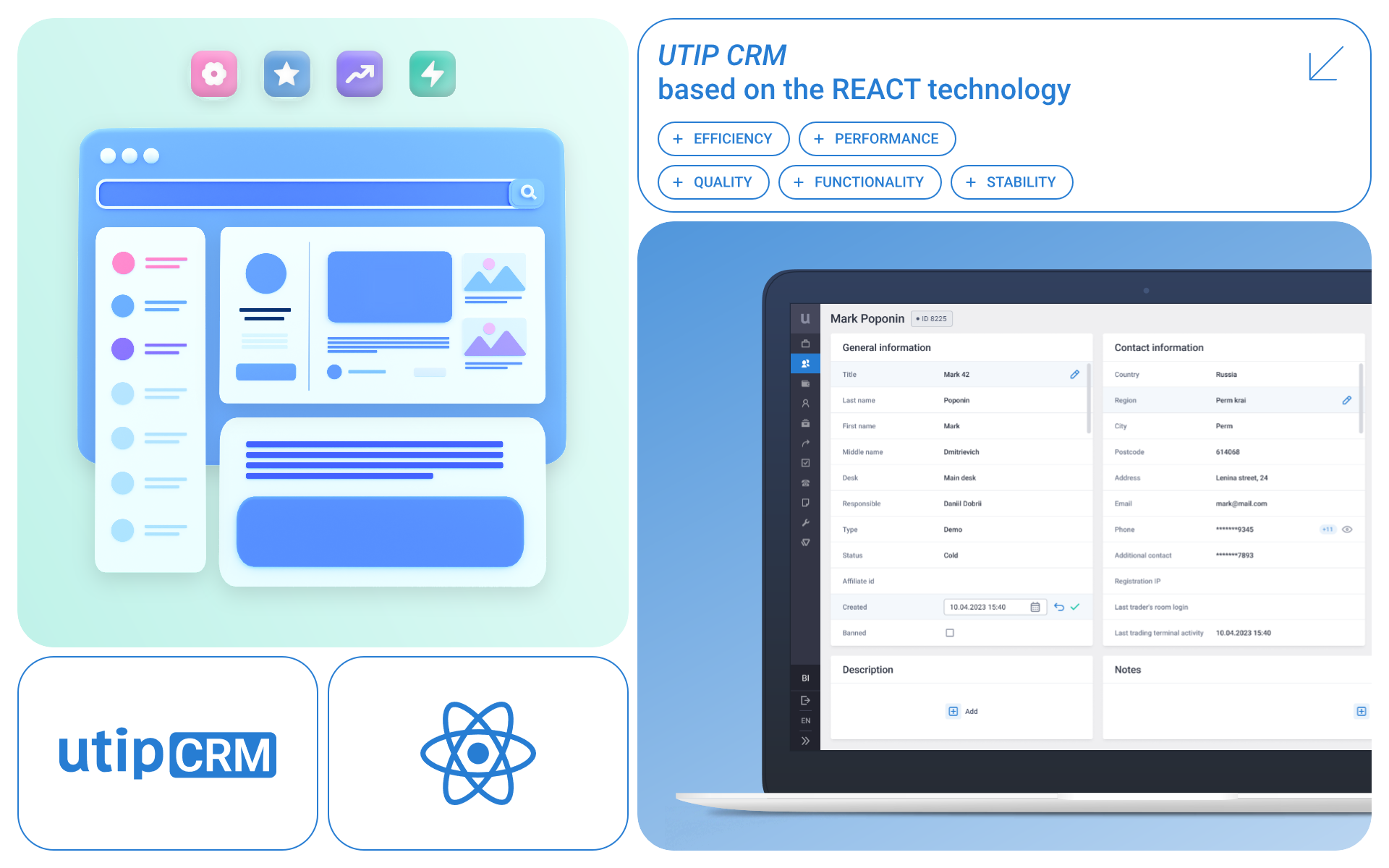

The UTIP CRM is a tailored-made system for fast and continuous integration between brokers and their clients. The platform stands out among its peers due to the innovative design and high-end functionality. All these features ensure the best customer support throughout the whole sales funnel.

Key steps for processing leads in the UTIP CRM

The UTIP CRM has ready-made solutions for each stage of lead processing, i.e. from lead creation in the CRM-system to making the first deposit.

- Lead generation

- Qualification

- Interaction

- Lead conversion into an active client

- Metrics and analytics

Take a closer look at how the UTIP CRM can help your business thrive.

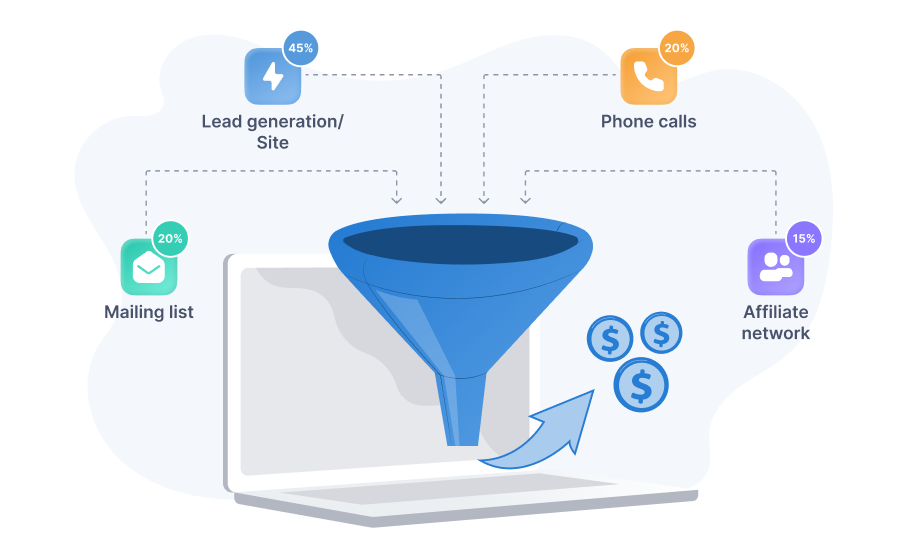

Lead generation

Leads are fetched by the brokerage firm from multiple channels.

The main lead streams include:

Mailings. Sign up to receive newsletters, emails with offers, promotions, and news.

Phone calls. Generate leads by making outbound calls to customers.

Website. Leave your contact details via feedback forms on the website, or landing pages.

Partner network. Source leads from partners and affiliates.

Lead generation. Receive leads through various marketing channels, contextual advertising, social media, etc.

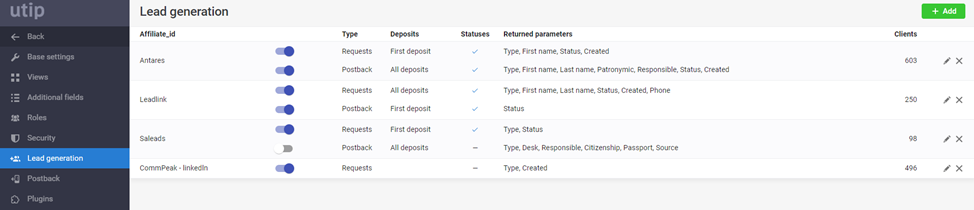

As far as our experience goes, brokers are more likely to use lead generators in order to get clients. That’s why our team has launched the lead generation functionality, being previously covered in the article.

This function greatly simplifies the process of integrating a lead generator into the UTIP CRM. It takes just 3 days to complete. The system receives leads in real time due to the Postback feature.

The UTIP customers have already integrated with more than 20 lead generators, including the major aggregator Trackbox as our respected partner.

Qualification

Unqualified leads can limit your ability to create a case-by-case approach. This undermines effective communication and full compliance with the client requirements.

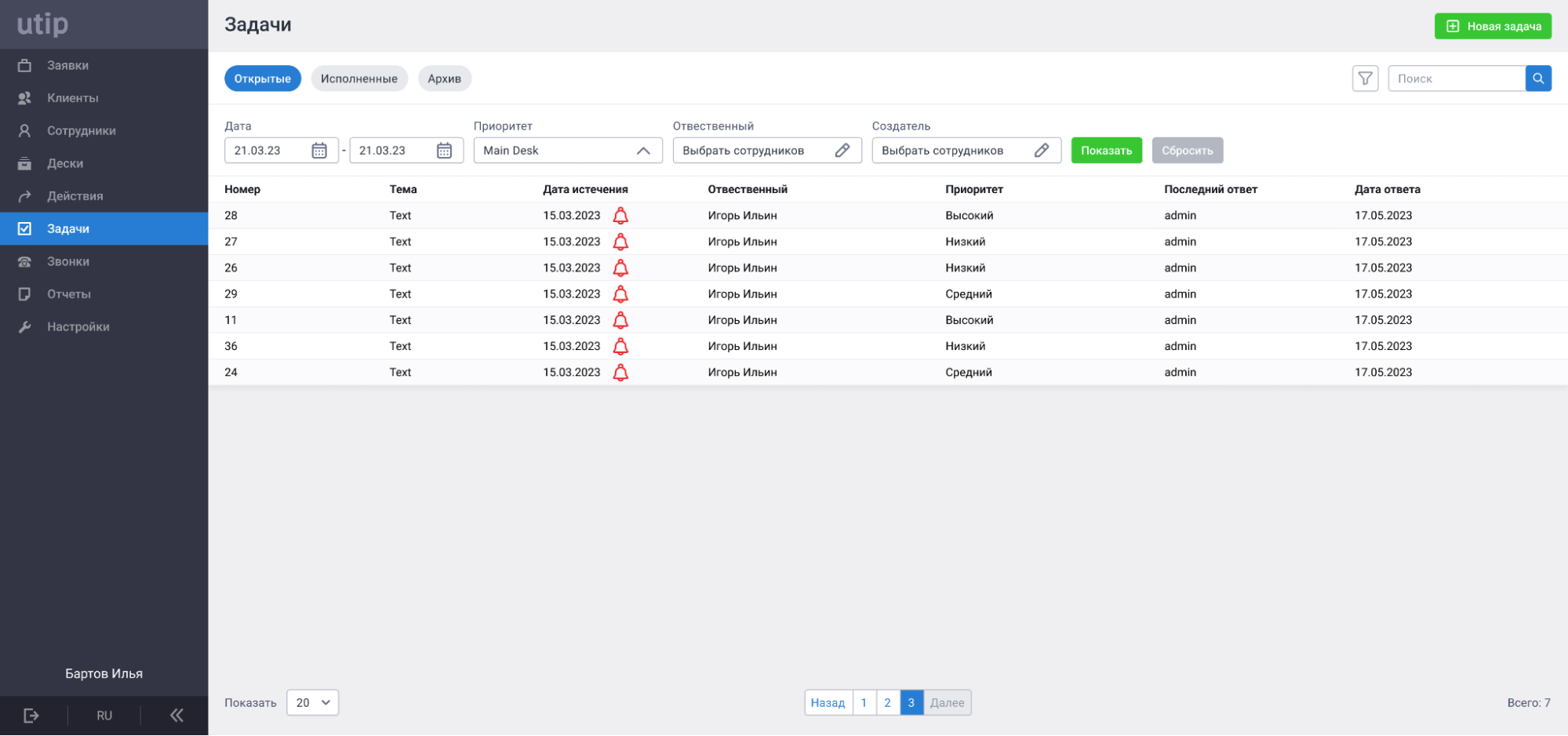

In the UTIP CRM, a broker is able to create any set of custom views and statuses. This allows the user to tailor the system to their own needs. For example, one can determine the viability of each lead and optimize the methods of working with them based on their performance and business profile.

The UTIP CRM users note that this setting reduces lead processing time by 20%.

Interaction

Once a lead is generated, a manager needs to interact with it. The UTIP CRM allows you to assign certain managers responsible for customers, as well as to distribute them among the relevant desks for further cooperation.

The manager is a key contact person between the company and the client. This individual is committed to building and maintaining relationships with each service receiver. Their duties include: processing requests, providing information about the company’s products, making sales, and rendering customer support.

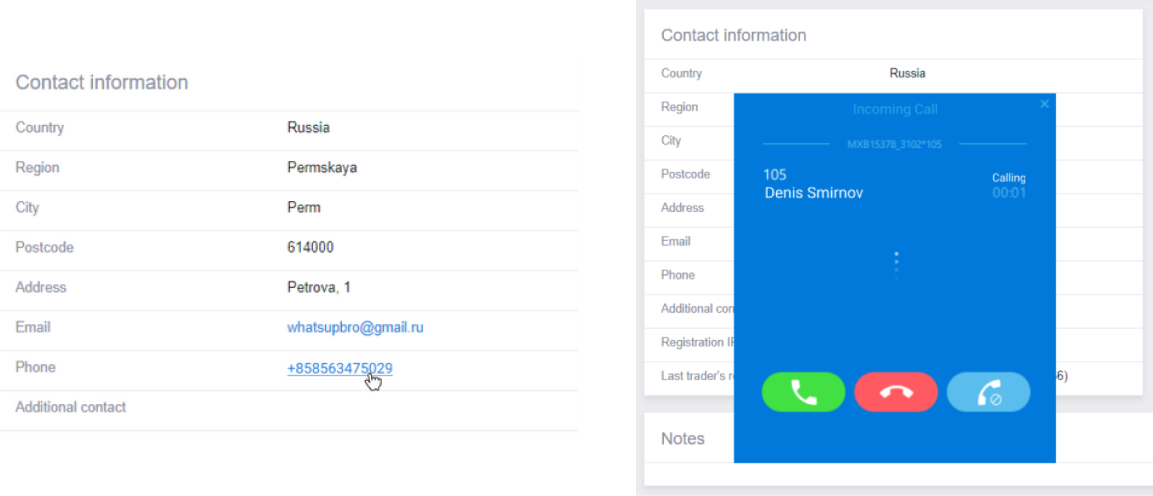

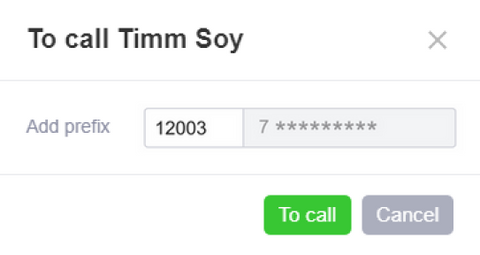

For better interaction between managers and clients, you can connect IP telephony plug-ins in the UTIP CRM and organize a call center to track their statuses and content. These modules make it easier for managers to receive calls. One click is enough to get in touch with a client.

The UTIP Technologies Ltd. customers have already connected such high-profile dialers as Voiso, Commpeak, Binotel.

Lead conversion into an active client

Once a lead has gone through all the previous stages of the funnel and is ready to become a full-fledged market player, all you have to do is to switch to the Trader’s Room and sign up by filling in a couple of fields.

The system will automatically register your client, open an account and redirect them to the deposit page. The process is fully automated so no errors on the client’s part are taking place.

Managers can also register a client in one click directly from the UTIP CRM. Therefore, a trading account is automatically created on behalf of your customer.

After making the first deposit, your lead turns into a trader and is free to perform transactions in the terminal. There is no need to enter any additional credentials to switch between the Trader’s Room and the terminal as both programs are one-system wired.

A trader has to log in once to easily navigate between these apps. It is also possible for market participants to trade directly in their profile.

The UTIP CRM is able to automatically detect when a customer logs into the Trader’s Room, opens a live account, makes a deposit and displays the corresponding client status. This is how you never miss a single step in a potential client’s development into a full-fledged trader.

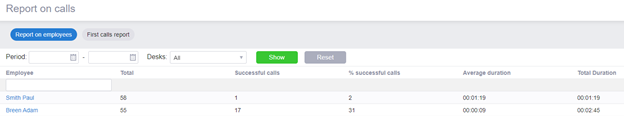

Metrics and analytics

Without reporting, companies fail to evaluate the success of lead generation techniques. As a result, you may choose the wrong strategy and pass up the opportunities to make the running.

One of the UTIP CRM benefits include tracking various metrics and analyzing the lead processing performance. That’s why our experts have already integrated built-in reports and the views functionality.

Views represent a fixed set of columns and filters for displaying information in a table. For instance, you can create views with the employee’s leads for a specific period of time by using certain configurations and switching back and forth in one click.

___________

The UTIP CRM is used by more than 5,000 employees of brokerage firms on a daily basis. This proves that the product is of great utility and acceptance in the Forex industry.

Join the UTIP CRM right now to uncover new ways to succeed in the brokerage world!

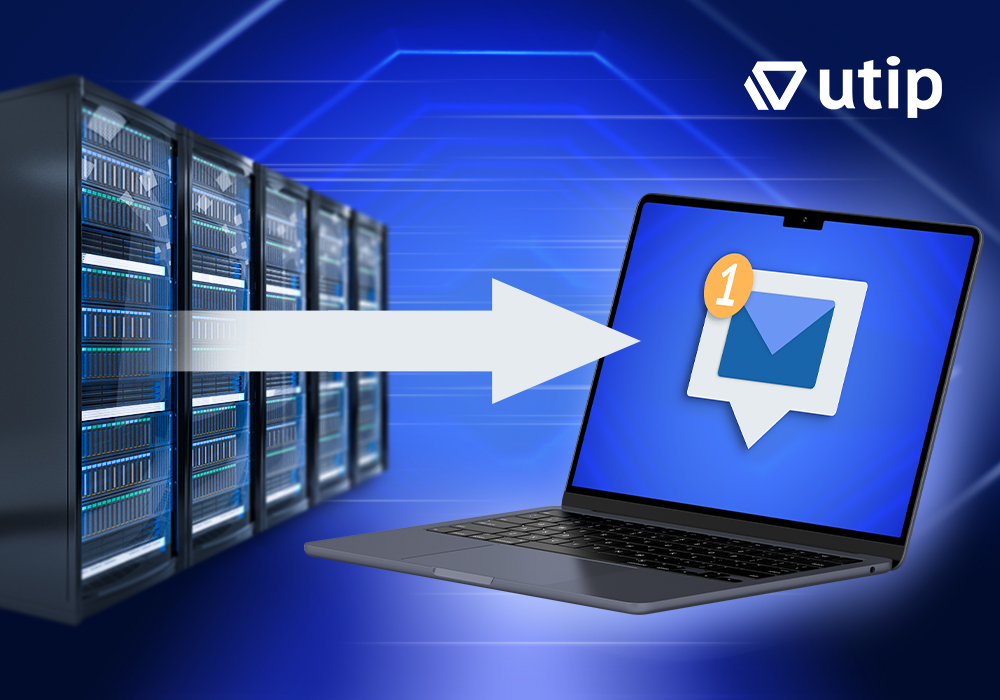

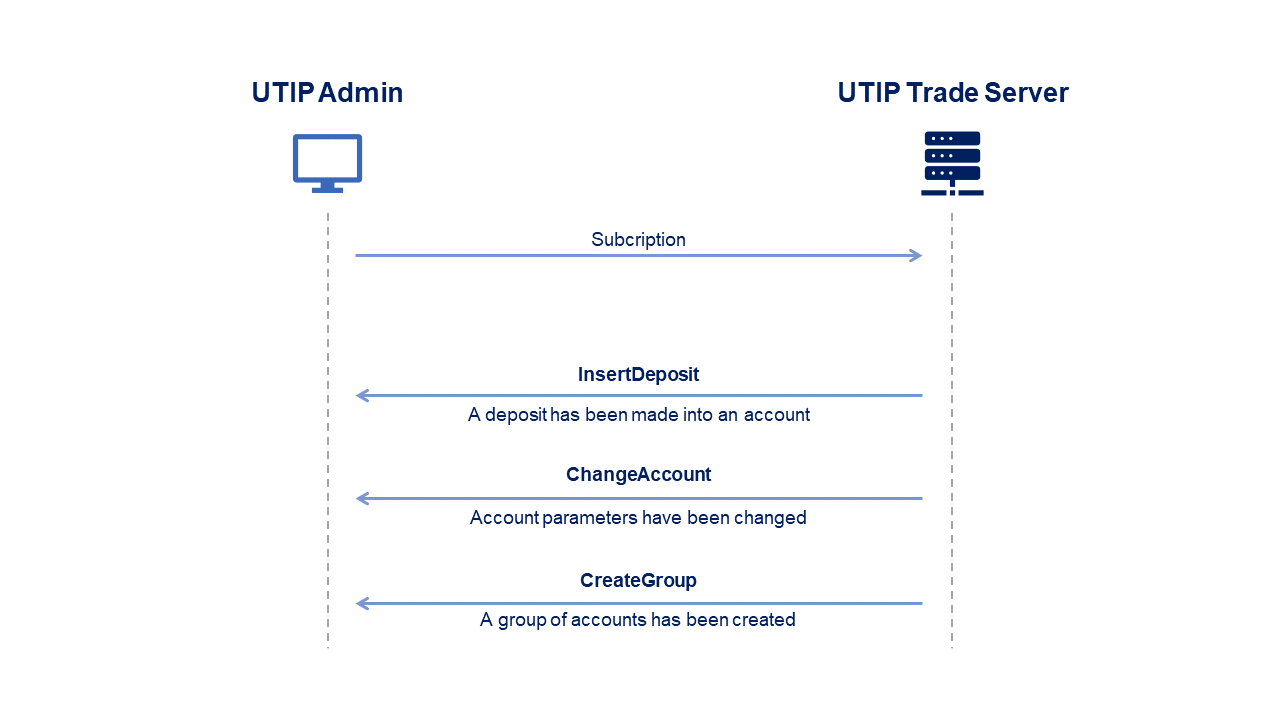

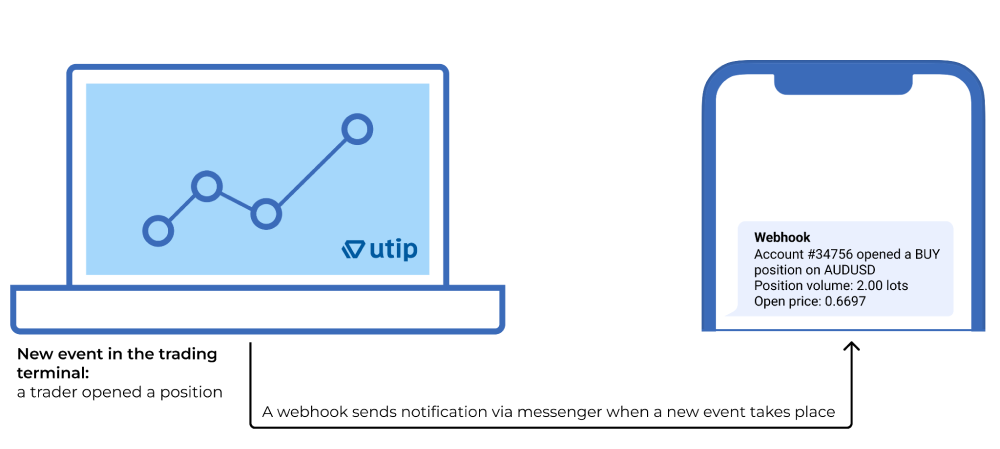

In today’s rapidly changing world, it is essential for a broker to keep abreast of the events. For this reason, the processing speed of a dealer’s activity on the market, i.e. trading positions and deposit operations, is a crucial point for the brokerage firm. This allows the broker to respond quickly to the changes and mitigate risks. UTIP Technologies Ltd. strives to provide brokers with such opportunities, thus having integrated a webhook functionality into the UTIP Trade Server, which is featured by automatic event notifications sent to other applications and services.

My name is Alexander. I’m a product manager at UTIP Technologies Ltd., being responsible for the UTIP Server, UTIP Manager and UTIP Desktop products. As part of the releases of the UTIP Trade Server over the past year, the webhook functionality has been implemented and improved. This article covers the way we have increased the processing speed and data security of traders’ and managers’ activities in the UTIP Admin, a web application designed for Forex administration staff.

Webhooks vs API

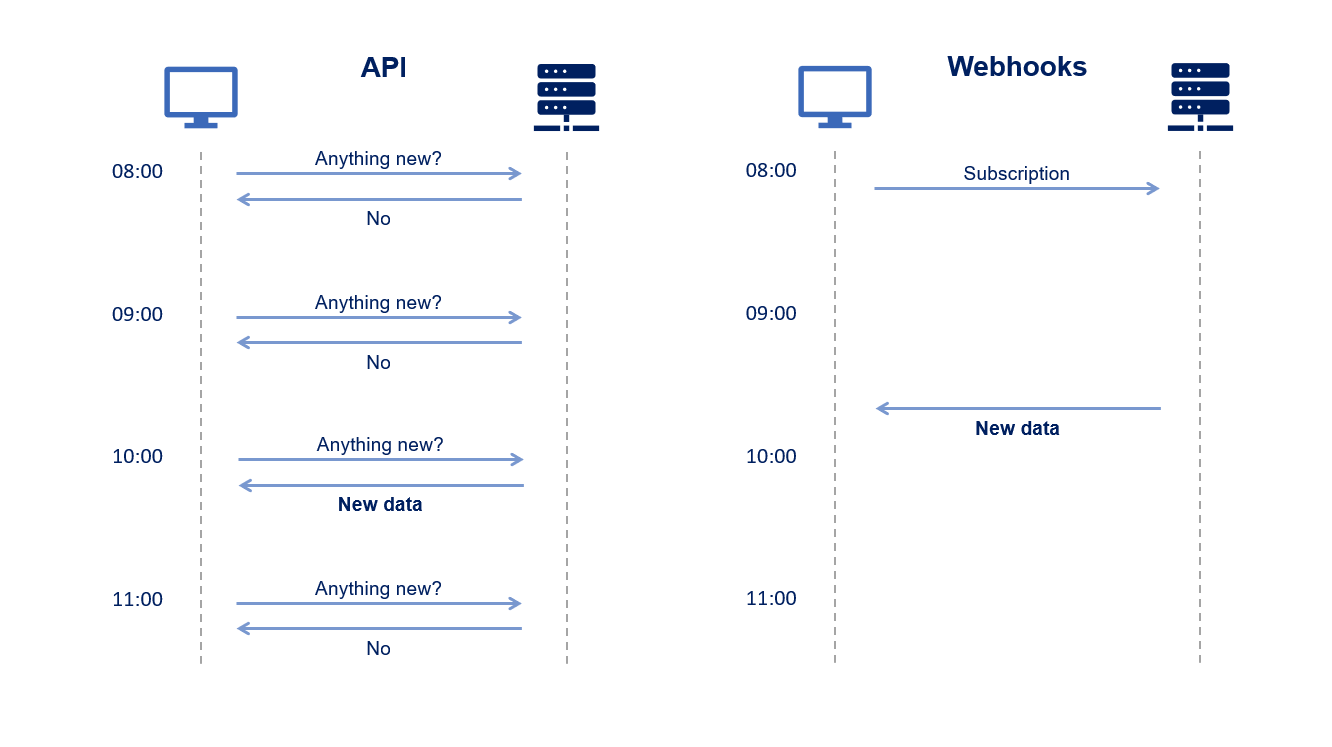

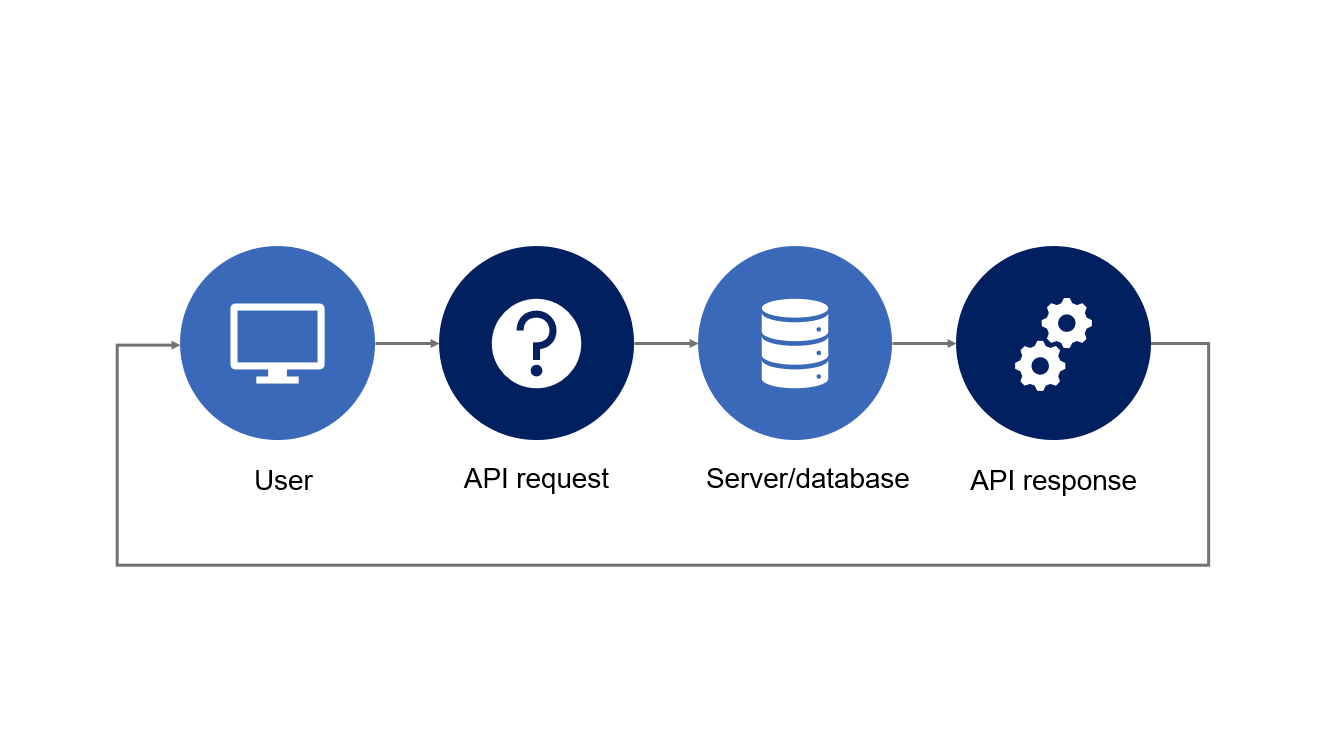

A webhook is a user-defined HTTP callback that is triggered by the predetermined event. In plain language, webhooks serve as a bridge between a foreign host and clients. Other common terms for webhooks are “web callback” and “HTTP push API”. As soon as the designated event occurs, webhooks immediately send data to the recipients. The server sends data via an HTTP request (usually a POST method) to the URL configured for the webhook.

API — application programming interface that can be used for similar purposes. It is a kind of digital infrastructure for data exchange between the applications. The API requests data, checks for the presence of new information, and only then collects it. Multiple server requests shall be sent to receive data about the system updates. Webhooks are activated in response to an event, thus sending data to the recipient. It is enough to configure webhooks once to start getting data about the system updates. Webhooks are the best solution to be aware of the important events in real time. For example, once the trader changed their position, a dealing manager could respond to the action.

Expertise

According to the information given on the website of one of the UTIP alternative solutions, the platform has several application programming interfaces that make it possible to integrate it with trading and post-trading systems. For example, this platform has a Web API for integration with web resources and other services of the brokerage company. It means that the integration between the platform and supplemental brokerage services is based on the API.

The integration between the UTIP Trade Server and UtipOffice Platform has been ensured in the same way. In a certain period of time, the UTIP Admin requested new data from the trading server, so the integration was based on the queries to the UTIP Web API. There is no doubt that the UTIP Web API includes all the necessary tools for managing accounts and trading activity on the platform, as well as for generating different UTIP-based reports. Brokers can apply various functions to ensure integration with their applications and work automation. The following operations can be performed:

- create, change and delete accounts;

- make deposit operations;

- manage financial instruments and groups of accounts;

- obtain parameters of trading accounts and reports;

- and suchlike.

UTIP solution

We have revealed the space for improvements to reduce the server load. Therefore, a webhook functionality seems to be an appropriate tool for conveying updates in the system.

Currently, the UTIP Trade Server includes more than 10 events that users can subscribe to and receive notifications about without putting in extra effort. Webhooks are already being used in the UTIP Admin to obtain information about deposit operations, changing parameters of accounts and groups of accounts. We have streamlined the interaction between these applications. As a result, the administrative staff of the brokerage company can keep up with the trader’s information being updated, which positively affects the efficiency of business processes. Even now, you are able to use the UTIP webhooks for further integration of your services with the UTIP Trading platform.

Perspectives

The webhook functionality also caters for granting access to the certified liquidity providers. Such a partnership gives brokers the following advantages: access to interbank markets, minimal slippage in the execution of limit orders and the ability to hedge positions. In addition, the partnership with reputable liquidity providers can enhance the reputation of the broker’s brand, attract new clients, increase the conversion of deposits and profits.

To read more about the UTIP Trade Server and other UTIP products, leave a request on our corporate website, our manager will contact you and consult upon this and other offers.

Have you ever found a Forex broker’s website with no quotes or charts? Probably not. The network offers multiple brokerage services in different spheres: real estate, insurance, mortgage, shipping.

In what way can prospective clients differentiate the broker’s website dedicated to financial markets from others?

According to Nectafy, 73% of users just scroll through the information on websites rather than read it. This means that people underestimate most of the advertising slogans and benefits of the company’s products shown on the corporate website.

It has to be clear to your website visitors that you provide brokerage services. Otherwise, a potential customer closes the browser tab and accepts a competitor’s offer. Hence, the best way to keep clients is to set up a financial widget on the broker’s website. Currency rates, interactive charts, financial news — these are the competitive advantages of the broker who provides trading services.

My name is Alexander Shvorak, and I’m a website developer at UTIP Technologies Ltd. In the following lines I’ll go through a list of reasons for using financial widgets on the website.

Loyalty

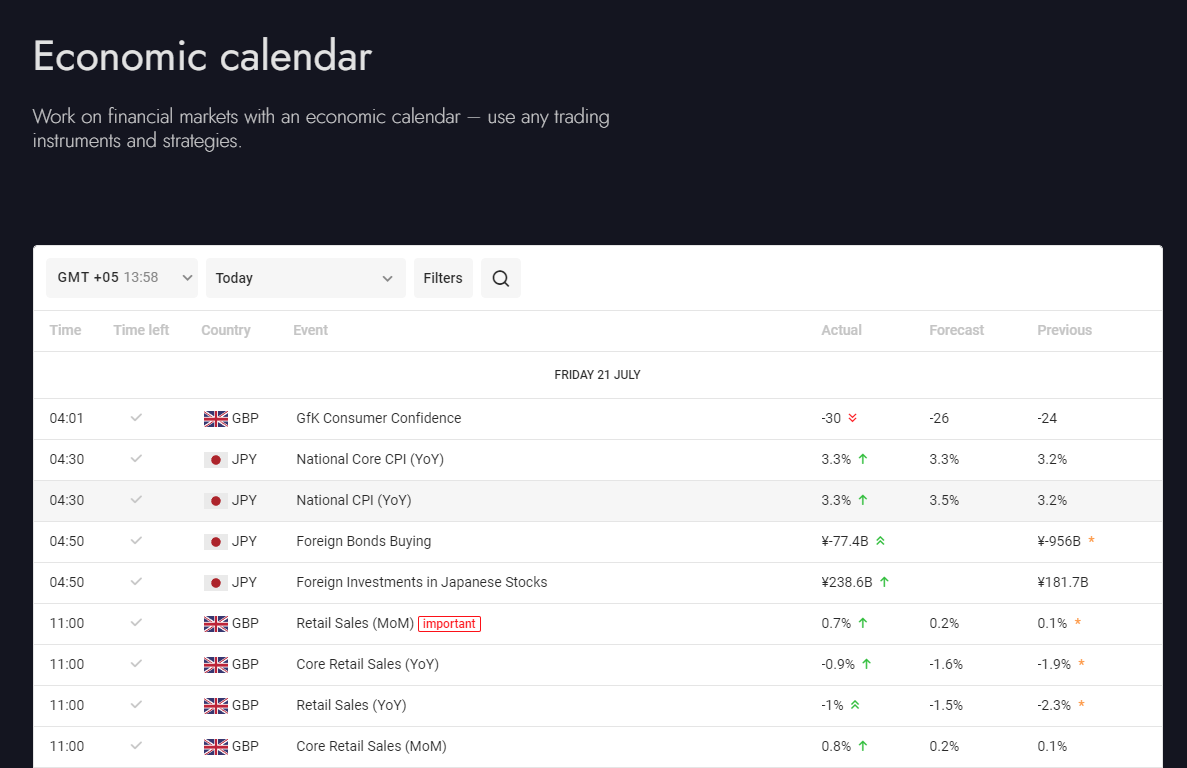

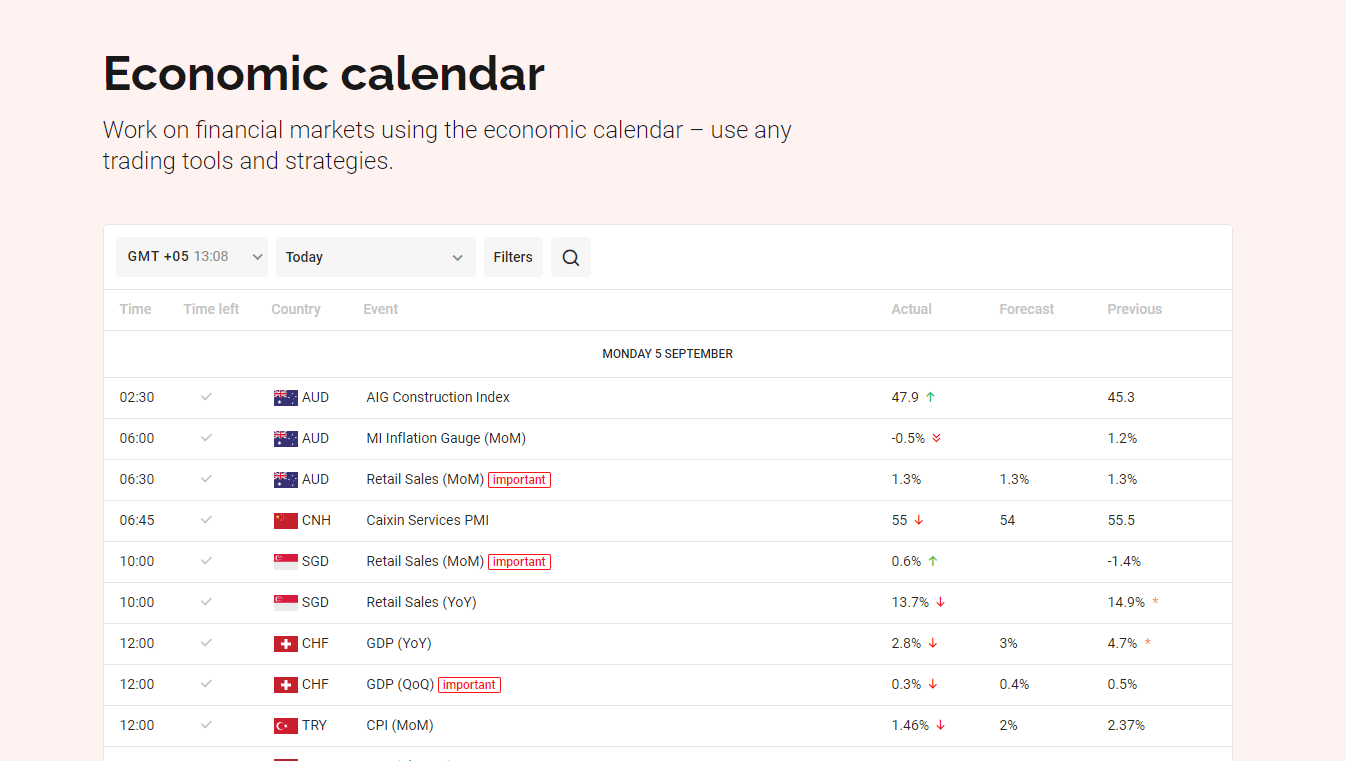

Customer loyalty is not for sale. Brokers spend thousands of dollars to attract clients. The majority buy ads on other network sources and further drive some traffic volume to their website. The website is a get-to-know place where potential clients learn about the company and open trading accounts. If you follow the same marketing strategy, you can boost your conversion by placing an economic calendar on the main page of the broker’s website.

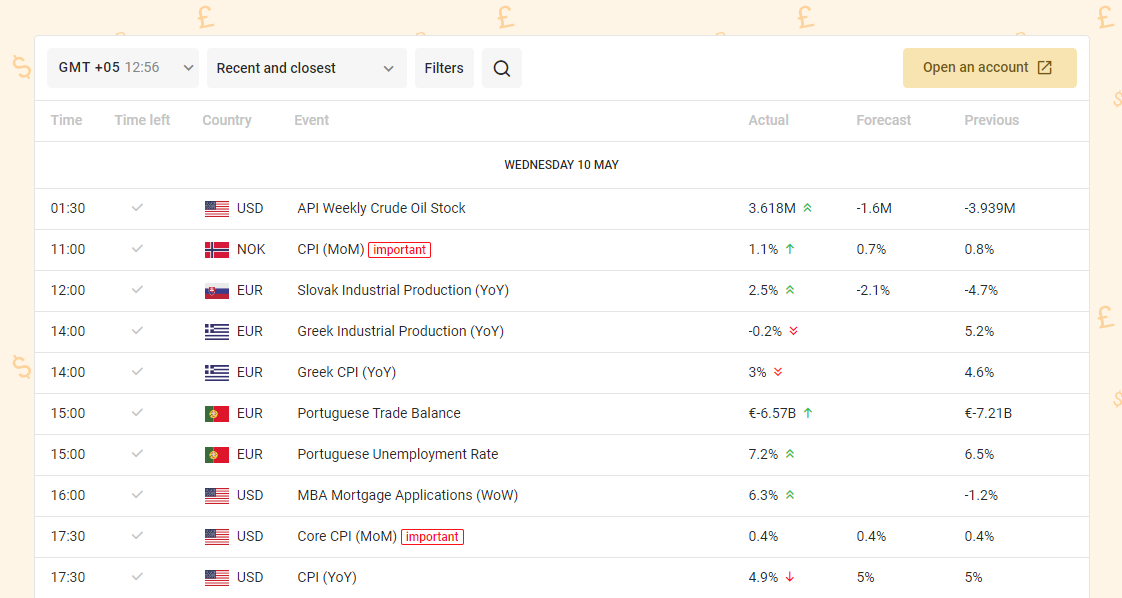

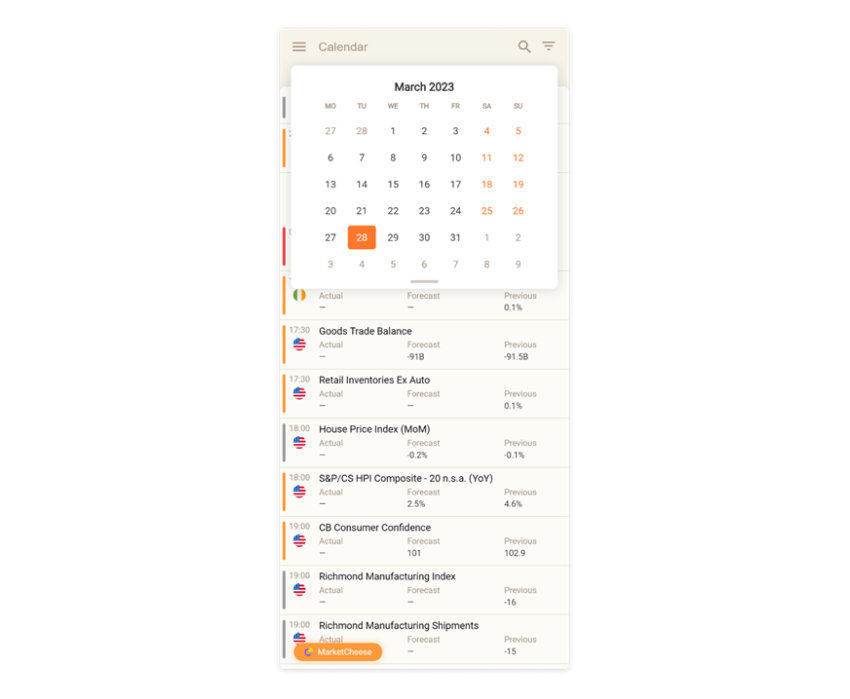

The economic calendar is one of the most popular financial widgets in the Forex market. Take a look at the MarketCheese one:

Financial widgets on the broker’s website is a good sign for your potential customers to get a full service package for profitable trading. This would definitely increase the loyalty to your brokerage services.

Expertise

The brokerage competence comes from the expertise in financial markets and awareness of the customer demands. Hence, every reputable broker provides its traders with a toolbox to invest money wisely.

Create a page with a variety of financial widgets on the broker’s website. This will increase your customer retention rate on the website.

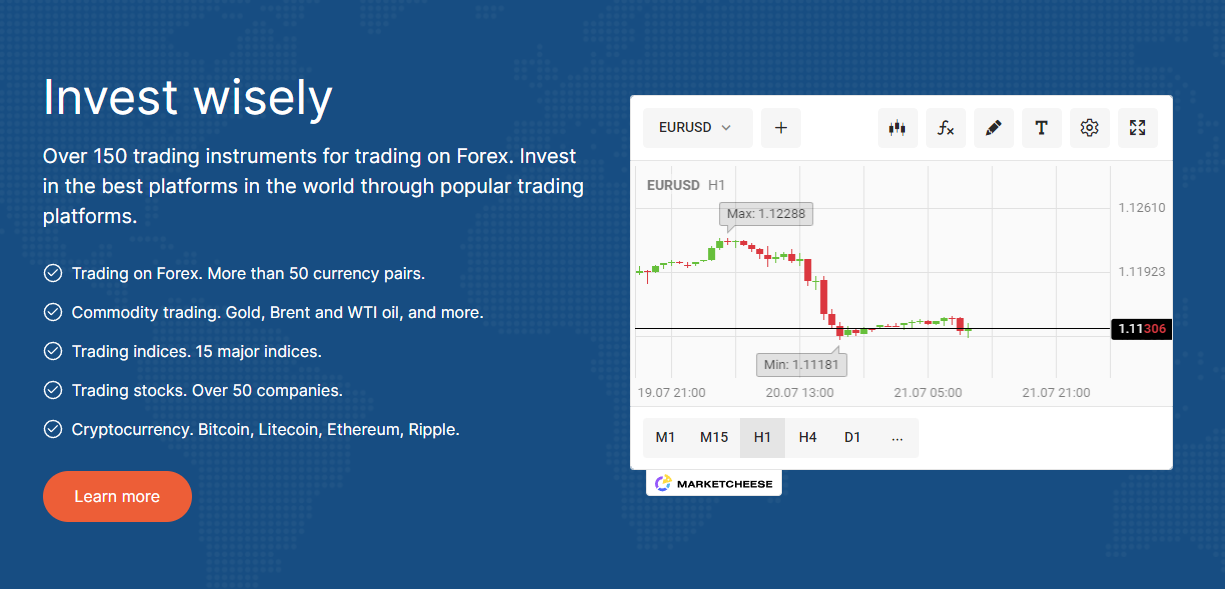

Redirect the traffic from the website to the Trader’s Room where clients can open and replenish their trading accounts. Add a “Start Investing” button or an advertising banner with a catchy slogan to the widget page:

Training

It’s easier for market entrants to understand the functionality of financial widgets rather than the trading platform Therefore, traders are able to apply all the financial widgets for educational purposes. It will contribute to the knowledge and experience of the future market participants.

For example, a chart widget, being as close as possible to the web terminal screen, displays the price movement on different timeframes:

Convenience

Financial widgets present a complete toolbox for technical and fundamental analysis right on the broker’s website. Therefore, market players can focus on trading instead of surfing the Internet and searching for trading tools.

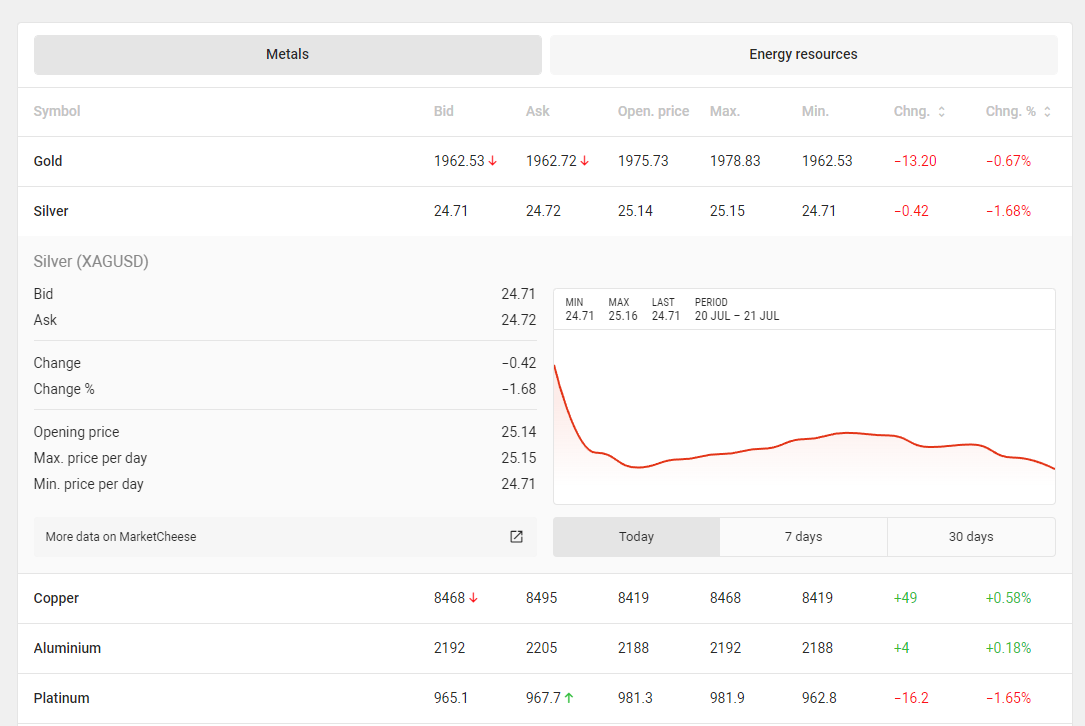

Here is an example of the financial widget “Quotes”, which contains recent information about asset value and its revaluation.

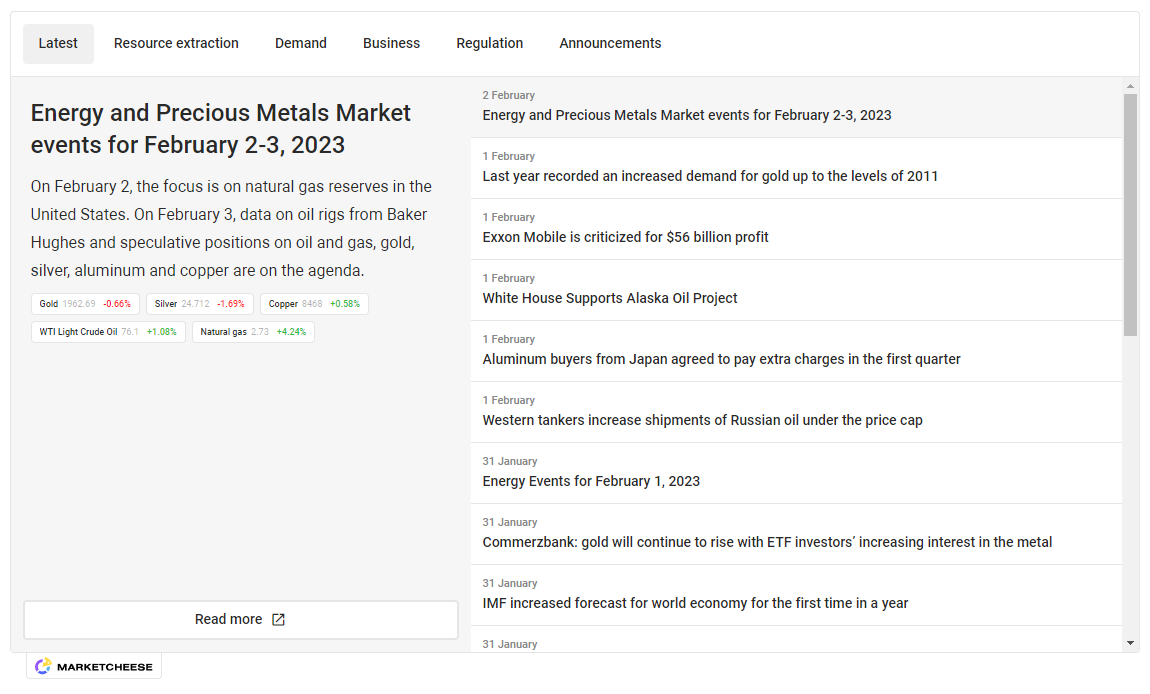

Recent information

The ”News” widget informs traders about a real-time situation in the financial market and economy. Another widget called ”Market forecasts” is made up of trading forecasts, ideas, hypotheses, analysis outcomes from market participants and experts all over the world in one spot! These widgets provide the most practical and noteworthy information about the current state of the market.

Clients will easily recognize the broker’s website with the latest market data posted via widgets.

Summary

One of the key features of the Forex website is a financial widget. That’s meant to be a competitive advantage of any brokerage company engaged in trading. Furthermore, it has been proven that the customer conversion and retention rates are high when using widgets such as economic calendar, quotes, charts and news. Traders appreciate brokerage experts and high-quality trading analytics.

Need more information? Do not hesitate to contact the website development team from UTIP Technologies Ltd.

Legal, financial and technical aspects are really important when setting up a Forex company. The choice of law and jurisdiction clauses are part and parcel of its incorporation.

Today, the issue of offshore registration has become more relevant due to the difficulties and nuances implied. In the present article we explain why it is necessary to get expert advice on incorporating a Forex company and reasons to choose UTIP Technologies Ltd.

Expertise

Offshore company registration can be a complicated procedure that requires in-depth knowledge of international regulations, tax and corporate laws. Experts in this sphere are skilled enough to guide you through the process hassle-free with no risks involved.

That’s why UTIP Technologies Ltd. is here to help you. Our company has years of experience providing offshore company incorporation services.

Customer-tailored approach

Each company has its own interests. By reaching out to professionals, you are able to receive expert advice in order to fulfill your expectations.

UTIP Technologies Ltd. offers a customer-tailored approach to the registration of offshore companies taking into account the peculiarities of your business.

Customer support

Offshore company registration is just the beginning of your Forex journey. Experts will be pleased to offer you a full service package, i.e. from registration to further assistance in the process of your business development.

UTIP Technologies Ltd. provides technical support for the platform, thus offering business consultations and connection of payment systems.

Safety and compliance with legal provisions

Offshore company registration is governed by international regulations. The UTIP experts will help you to manage compliance risks, thus keeping your business security and reputation.

Expertise is fundamental for incorporating an offshore company into the forex industry. Our professionals offer expert review, custom-tailored approach, support and compliance risk management for each client.

UTIP Technologies Ltd. has been delivering a full service package for offshore registration for the last 10+ years and brought companies forward in the forex industry.

Feel free to contact us with any questions related to company incorporation.

Modern technologies are quickly making their way into all business spheres, and the CRM system is no exception to the rule. One of the most advanced solutions to improve performance and functionality of your CRM is React. This article touches upon new ways to increase the UTIP CRM efficiency and provide quality customer support.

Improved performance

The React technology reduces workload on a browser and increases performance while processing large amounts of data. This is especially true when it comes to the CRM system, since its users tend to work with big datasets. By efficient component rendering, React ensures smooth interface operation and optimized CRM performance, thus increasing employees’ productivity.

Reliability and stability

React is one of the most popular and common solutions for UI development. This means that the UTIP CRM is being constantly supported and updated by our developers, ensuring bug fixes, improved performance, and system security. That’s what makes it a reliable tool with a high level of product stability.

Sophisticated user interface

React comes with extended functionality for setting up interactive and engaging interfaces. Through the use of components, the technology allows you to create dynamic elements such as filters, sorting tools, charts, and other objects that ensure the best customer experience. Intuitive interface of the CRM system also facilitates faster data processing.

Incorporating the React technology into the CRM system can be a great way to maximize performance, customize the UI, and ensure flexible development and support. Our CRM system is based on the React technology, making it easier for us to provide advanced features and functionality for customer and business process management.

Brokers using the UTIP CRM feel confident that they are getting a robust system that can process large amounts of data and provide great interface performance.

To find out more about the UTIP CRM, check out the UTIP website.

Lead generation seems to be relevant for all brokers, but the methods of working with potential customers may differ. Some companies buy client databases, while others use affiliate programs to attract traders, or take advantage of advertising, etc. It all depends on the broker’s resources and requirements. Thanks to the UTIP Technologies Ltd. extensive affiliate network, our partnership department has come up with new ways to generate quality traffic for the brokerage. This article provides an overview on these solutions.

SERM-marketing

SERM-marketing (search engine reputation management) is an online image building technology. This is a guerrilla marketing strategy, established by feedback and response-recommendations on the Internet to promote the brand across various communities. All the necessary information is placed subtly and only on the relevant platforms, thus allowing the company to deliver product details to potential customers and increase brand recognition among their target audience.

The system fosters client’s loyalty, minimizes negative publicity and generates new leads. Once the work has started, the tool collects detailed information about the broker. Next, the platform analyzes the current Internet environment and develops a step-by-step strategy both for placing the campaign on the websites (different parameters are taken into account: resource ranking, loyalty, etc.) and writing high-quality texts. This is followed by placing posts according to the predetermined schedule. In the process of their publishing, the following dialogues can be created: question-and-answer, discussion, help, etc. The feedback should also include screenshots from personal accounts on withdrawals and completed transactions. These reviews are likely to look natural, adding more to the broker’s credibility.

If there is not enough time, one can purchase ready-made domains with a positive track record. Favorable reports on the broker are quite beneficial for customer trust. In the past, a company had to wait 3-4 weeks after launching a project to build a proper image. The UTIP Technologies Ltd. affiliates figured out how to reduce this period up to zero. Now a broker can get a ready-made brand with a positive online reputation.

This includes:

- A domain (.com) consistent with the broker’s name, which was registered 2-3-6 months ago.

- Ready-made accounts on social media, containing posts on the broker’s activities and customer feedback.

- Brand blogs on popular websites, featuring articles about the broker and glowing reference underneath them.

- Review papers published on the news sites (media).

- Testimonials from satisfied customers on all the created venues.

Trading School

There is another related service for brokers, known as a trading school. Here you can create a school with webinars, online product placement, and automated sales funnels. The website can be full of training courses with a connected payment system. Moreover, business processes with descriptions, staff motivation and recruitment assistance are also provided within this solution.

If the lead generation topic is still of your interest, we will be pleased to answer your questions related to the company’s products and our partners’ services. To read more, follow the UTIP Technologies Ltd. website.

The UTIP trading platform is powered by a robust and high-end UTIP Trade Server that ensures the best system performance. This article discusses the reasons to choose a trading solution from UTIP Technologies Ltd. based on the benefits of the server and its functionality.

Stable trading server

UTIP Technologies Ltd. maintains stability and reliability of its platform. One server is able to support thousands of trading accounts, even if multitudes of them are active.

Moreover, our servers are protected by security protocols. This guarantees that the trading platform is fully resistant to DDoS attacks. Backups are regularly saved to ensure data safety.

Reliable quotes feed

The UTIP trading platform delivers quotes from reliable sources, so that they are in line with the market. In case of blackout period on the liquidity providers’ end, the quotes feed won’t be interrupted. No gaps in the history take place, and that’s why the archive integrity is maintained at the highest level. Selected “reference servers” are always in a work mode, enabling the system to synchronize the quotes archive. If physical servers hosting the UTIP trading platform fail or crash, gaps in the history are automatically recognized, and missing quotes for all symbols are downloaded from the basic and advanced packages.

Symbols diversity

The UTIP platform offers a wide range of trading symbols available in sets: popular currency pairs, cryptocurrencies, global stocks, indices, commodities and metals. These symbols are constantly updated with top-trending instruments. The extended package now includes over 250 trading tools.

Flexible settings

The UTIP Manager is used to configure the trading platform and oversee the clients’ accounts. It is a visual interface of the server.

Brokers can easily tailor trading conditions to their needs. Multiple customization options, including swaps, spreads, commissions and other parameters, facilitate compliance with the trading conditions of the major brokers, thus reducing risks and increasing traders’ loyalty.

To find out more information about the UTIP trading platform and other company’s products, visit our website.

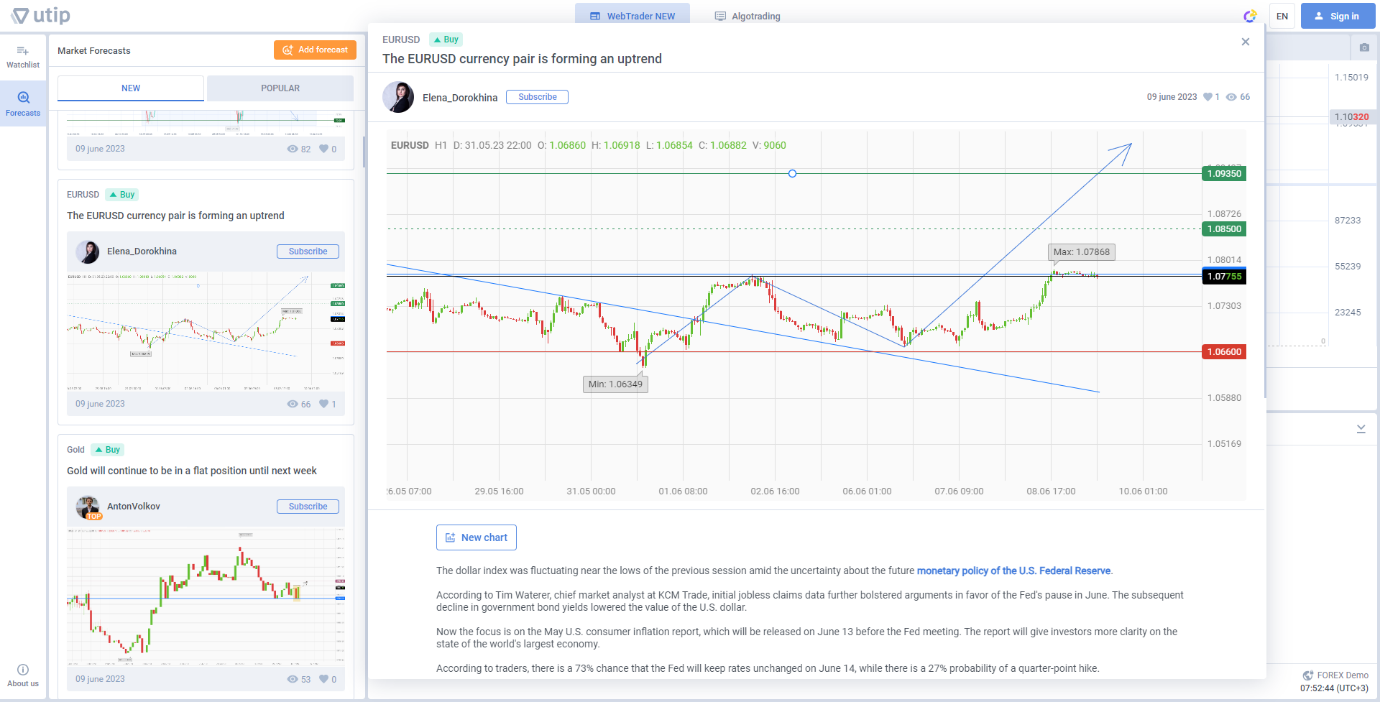

The number of investors who apply forecasts in their trading strategies is growing. This is a unique tool that allows market players to implement successful and profitable models in the financial market. The present article covers the concept of forecast trading, its advantages, and ways of its implementation in WebTrader New by UTIP Technologies Ltd.

Concept of Forecast Trading

Trading on forecasts entails that historical data and price trends may provide insight into future market changes. Forex dealers use multiple tools and methods to analyze this information and make predictions on whether to buy or sell assets.

Experts try to foretell prospective market fluctuations, especially in regards to a particular asset, using this type of data. Forecasts are usually based on fundamental (economic news and events) and technical (charts, indicators) analysis, as well as other factors that can influence the market state.

Forecast Benefits

When it comes to forecast trading, there are three major benefits.

- The concept enables predicting potential price movements. Therefore, a trader is able to generate profit from the market volatility.

- Forex participants are provided with statistical models and analytical tools to determine the best entry and exit points. This facilitates successful risk management and great transaction performance.

- Trading forecasts are published for different market segments, including Forex, stocks, commodities and cryptocurrencies. Hence, the investor’s capabilities are expanded.

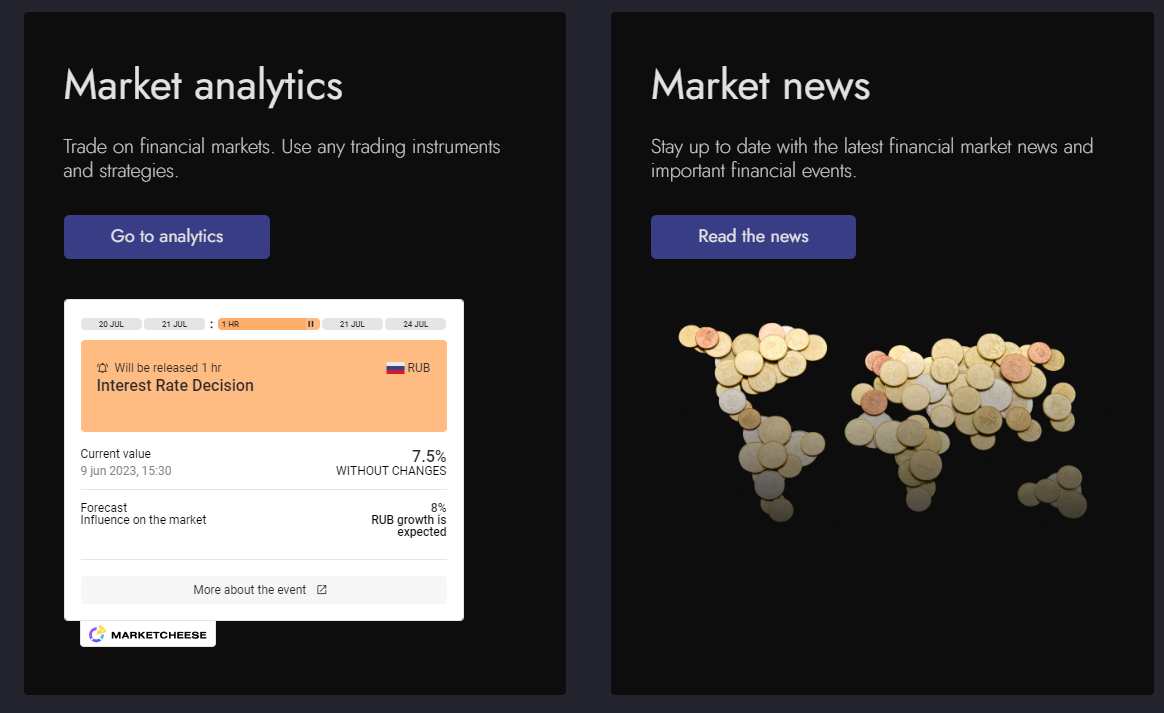

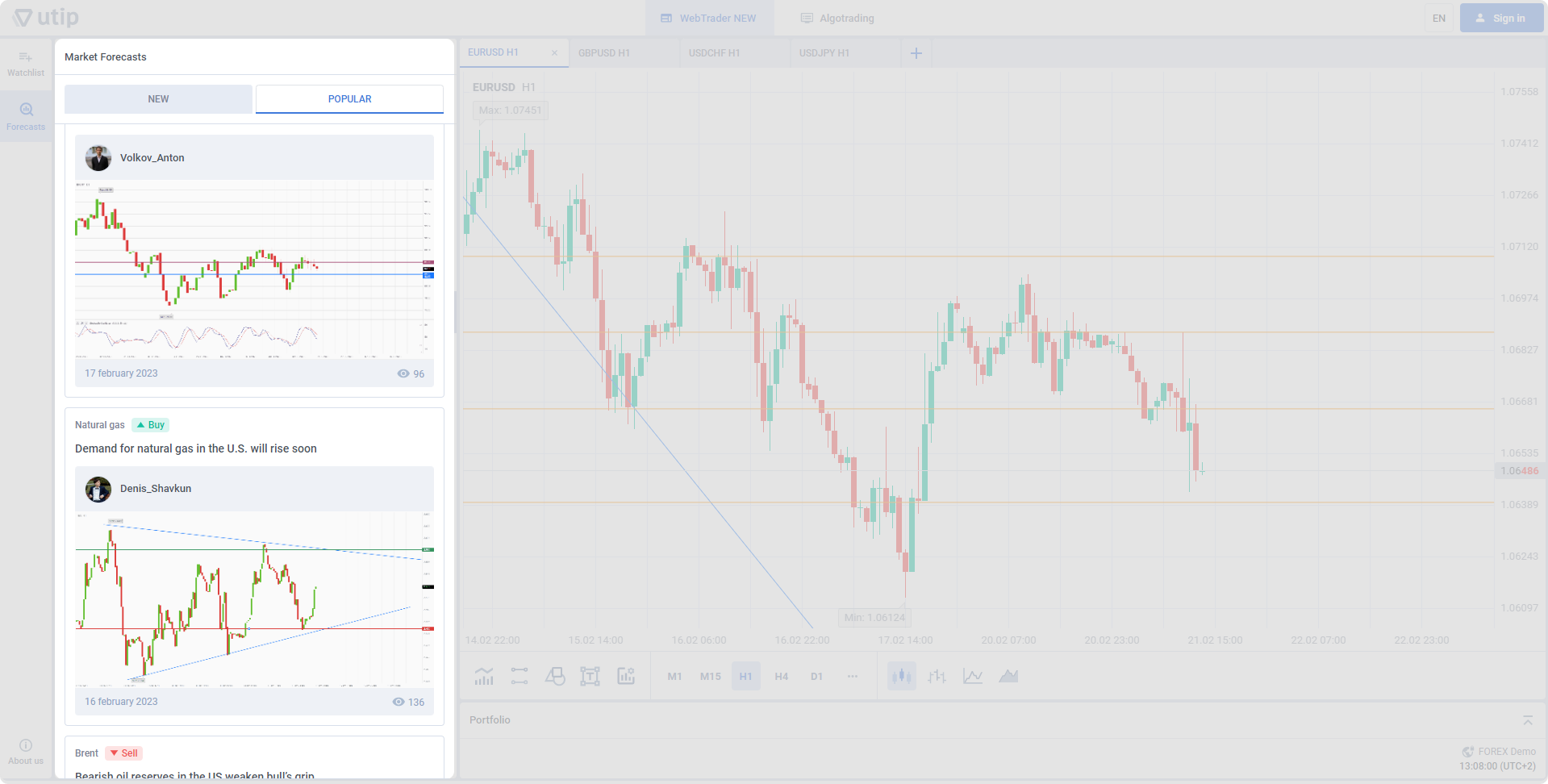

Forecast Trading at the UTIP Web Trader New

UTIP WebTrader New features a built-in module with trading forecasts, which are provided by the MarketCheese analytical service. Through the integration, traders gain access to the forecast feed, and review publications by MarketCheese financial experts and other community members. Analyst projections might be helpful when making decisions about your deals.

Traders are provided with the most relevant forecasts directly from the trading platform. There is no need to search for the sources outside the terminal, which saves time and effort spent on data retrieval. All these features make the system more user-friendly and attract people who appreciate quick and easy access to analytical content.

Forecasts can be sorted by popularity or novelty. You can also split them by the author you are interested in, or look through the projections for one particular symbol. A convenient subscription panel makes it easier to compile your own collection of authors and keep up with the latest news. Forecasts are also divided by market segments, and traders can select the most appropriate publication for their trading strategy.

Clients can import forecast charts to their personal workspace in order to copy other trading strategies. The terminal charts are filled with technical analysis tools, drawing and commentary objects, and indicators. Traders are able to mark all the key points on the charts, i.e. support and resistance levels, trend lines and patterns. Moreover, one can easily analyze and predict price fluctuations, or create and publish a personal forecast directly in the trading platform.

Publications written by our authors are in line with the market moves. There is a feature to view the price history for each forecast and check if it was correct or not.

UTIP WebTrader New has been enhanced with forecasts, thus introducing a great solution for market participants. Traders benefit from extensive analytical functionality and have access to the major analytical service community, while brokers receive an excellent opportunity to encourage their target audience to be active Forex participants.

If you want to know more about the UTIP WebTraderNew and other company’s products, submit a request on the UTIP website.

Brokerage activity in over-the-counter (OTC) markets depends on the country and its connection to payment solutions. Domestic legislation, geopolitical situation and cultural background — all these factors can affect brokerage terms and conditions. According to legal requirements, countries can be divided into three groups, the UTIP Technologies Ltd. experts say.

Group №1

Countries: some Southeast Asian and African states, along with CIS and Latin America.

The countries mentioned above provide a great selection of service suppliers and payment methods. Standard bank acquiring is not common here. In most cases, there are alternative options, such as p2p, local payment systems, or online banking. All of these methods are aimed at cutting broker’s expenses, while maintaining a high percentage of payment conversion.

Group №2

Countries: Europe and the Gulf Cooperation Council (GCC).

The second group has stricter regulatory and documentary requirements. Brokers dealing with traders from these regions need to comply with the existing rules and obtain multiple licenses and certificates for their activities. This may have a negative impact on their financial viability. But there is one way to receive payments from Europe: open a bank account for a newly established company, or create a payment gateway on your own.

Group №3

Countries: Japan, Canada, Australia, Israel and the US

Regulatory requirements in these countries are as stringent as possible. Brokers interested in clients over there are obliged to meet high standards and receive special licenses. Violation of the rules entails serious financial and legal liability. Most market players recommend to avoid cooperation with the third group of countries in order to prevent negative consequences for a broker, even despite him being a legal entity. Compliance agents within these jurisdictions can be extremely persistent in shutting down and blocking Forex dealers.

Some countries also present leverage limitations, thus putting bounds to the trader’s flexibility and broker’s profitability.

Overall, finding the best jurisdiction and connecting payment solutions are major hurdles to run the brokerage in the OTC market. Each region has different requirements and restrictions that can affect both business conditions and market players’ effectiveness. The list of mandatory documents varies from partner to partner. Some affiliates are ready to cooperate without a registered legal entity, while others require a license. Most companies are open for partnership only if they have a full-fledged legal component.

The UTIP Technologies Ltd. Experts would be pleased to assist you in payment system selection by taking into account individual Forex broker’s circumstances in the first and second groups of countries.

The UTIP Web API and Webhooks are two powerful tools for getting data and running a trading platform that help brokers to maximize profitability. Despite both tools being used to interact with data, they are not interchangeable, and rather serve different purposes. This article covers the key differences between them.

UTIP Web API

API is an abbreviation that stands for application programming interface. It is a kind of digital infrastructure to exchange data between applications.

The UTIP Web API contains all the basic tools for managing accounts and trading on the platform, as well as for making various reports on the UTIP development. Brokers can apply multiple functions to integrate with their applications and automate their work, for example:

— to create, edit and delete accounts;

— to make deposits;

— to manage account groups and financial instruments;

— to receive parameters of trading accounts and trading reports, etc.

Webhooks

The webhook can be translated from English as a “web interceptor” – or even literally as a “web hook”. By its means, one application transmits information about a real-time event to another. As soon as the event occurs, the webhook is triggered to pass the given information to the corresponding program.

The UTIP server uses webhooks to notify recipients when data has been refreshed. These notifications contain information about the type of event and the parameters being processed. The system sends notifications immediately and only for the updates that are requested by the recipient.

Additionally, webhooks are used to access liquidity from certified providers. The liquidity provider partnership gives brokers the following advantages: access to interbank markets, minimum slippage in the execution of limit orders and the option to hedge positions. Furthermore, brokers can enhance their brand reputation, attract new clients and increase their deposits and profits.

Key Differences

The API requests data and checks for new information before compiling it. The server can be queried several times for information about the system’s updates.

Webhooks are activated in response to an event, and they send the relevant information to the recipient. Webhooks are set up once so that it will be enough to further receive data on updates in the system.

Webhooks are an efficient way to get important updates in a timely manner. As an example, a dealing manager can quickly respond to the actions from the trader’s end while editing a position. It’s important for brokers to stay up-to-date, and webhooks are the best alternative to the API to receive the latest information quickly. Hence, the UTIP trading platform developers have already implemented the webhook feature adjacent to the multifunctional UTIP Web API.

For further information about the advantages of the UTIP Server, follow the UTIP website.

Some information about clients can quickly change and go out of date. This article from the UTIP Technologies Ltd. specialists explains why staff turnover is risky for your business, and how the “History” section in UTIP CRM keeps your sales on track.

Pitfalls of Staff Turnover

A key concern about staff turnover is that trusted and experienced specialists leave the company in order to be replaced by new employees, who need to be trained from scratch. This affects both company’s financial health and profitability, which is especially true for start-ups. Moreover, a client usually gets accustomed to their manager and may choose not to cooperate if the specialist quits their position.

Staff turnover can also reduce labor efficiency of the remaining employees. The interaction process can be disrupted as workers are forced to take on extra responsibilities and master new skills. To avoid a deadlock within the company, a manager has to figure out how to reduce personnel rotation and resolve this issue.

UTIP CRM provides higher revenue retention and faster employee onboarding

Sales departments are often subject to higher staff turnover than other divisions. This is due to the fact that working as a salesperson is difficult. UTIP CRM guarantees that sales departments are not lagging behind when it comes to personnel replacement and makes sure that a new manager has enough time to process requests. Thus, there are no unsatisfied customers, who may leave you for a competitor.

UTIP CRM saves all the client history, i.e. phone calls that can be replayed in the system, messages sent on email, face-to-face meetings, and completed or failed transactions. New managers, in this case, can quickly learn the specifics of work with each client.

In addition, the “History” section is a great way to make a difference when contacts get lost: for example, there is a failure in the spreadsheet, or managers don’t have enough time or forget to update the system. This is also helpful when the client finally decides to buy a company’s product after several months of thinking, and the old request is no longer available. Information from the last 6 to 12 months is often removed from the database, and a manager sees the client as a new one. So, the customer has to recount his problem, while the employee needs to collect and record information that could have been obtained in a few seconds if the company had installed a CRM.

The history also allows senior staff to track task completion by managers, analyze the performance of employees, departments or the entire company, and provide the best customer experience.

Nowadays more and more businesses implement a CRM system as it is a user-friendly, cost-effective and affordable solution. You can find a one-size-fits-all program or tailor it to the needs of a particular company. The most important thing is to define your business goals and objectives in order to maximize the effect of working with the CRM system.

If you have any questions about UTIP CRM, feel free to contact our support team.

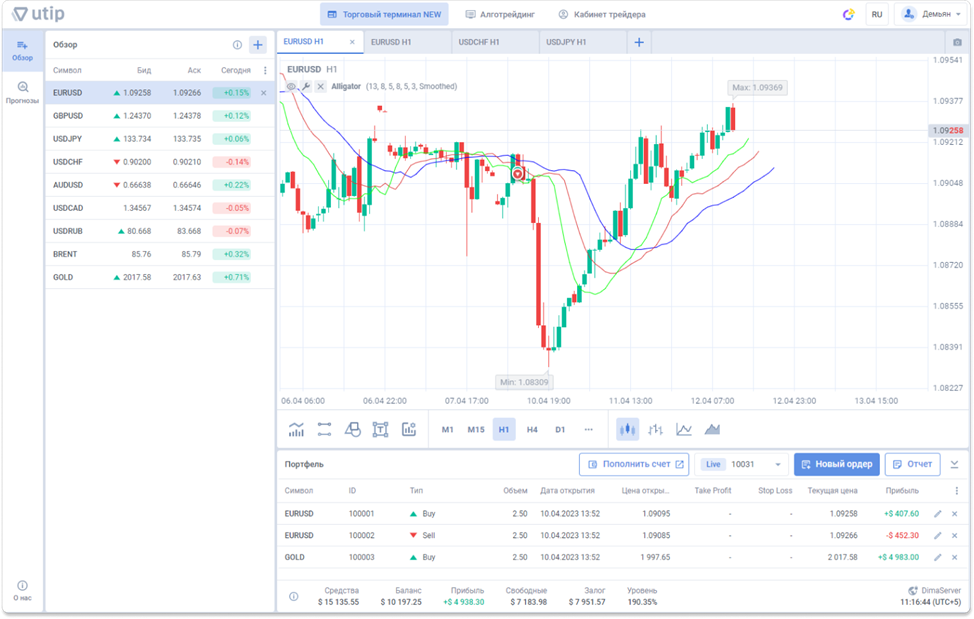

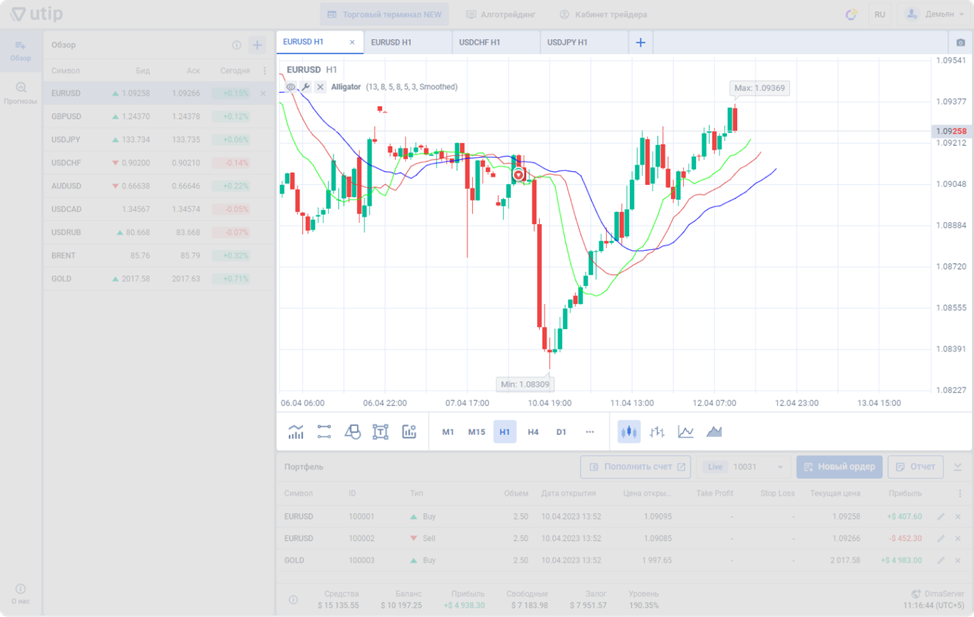

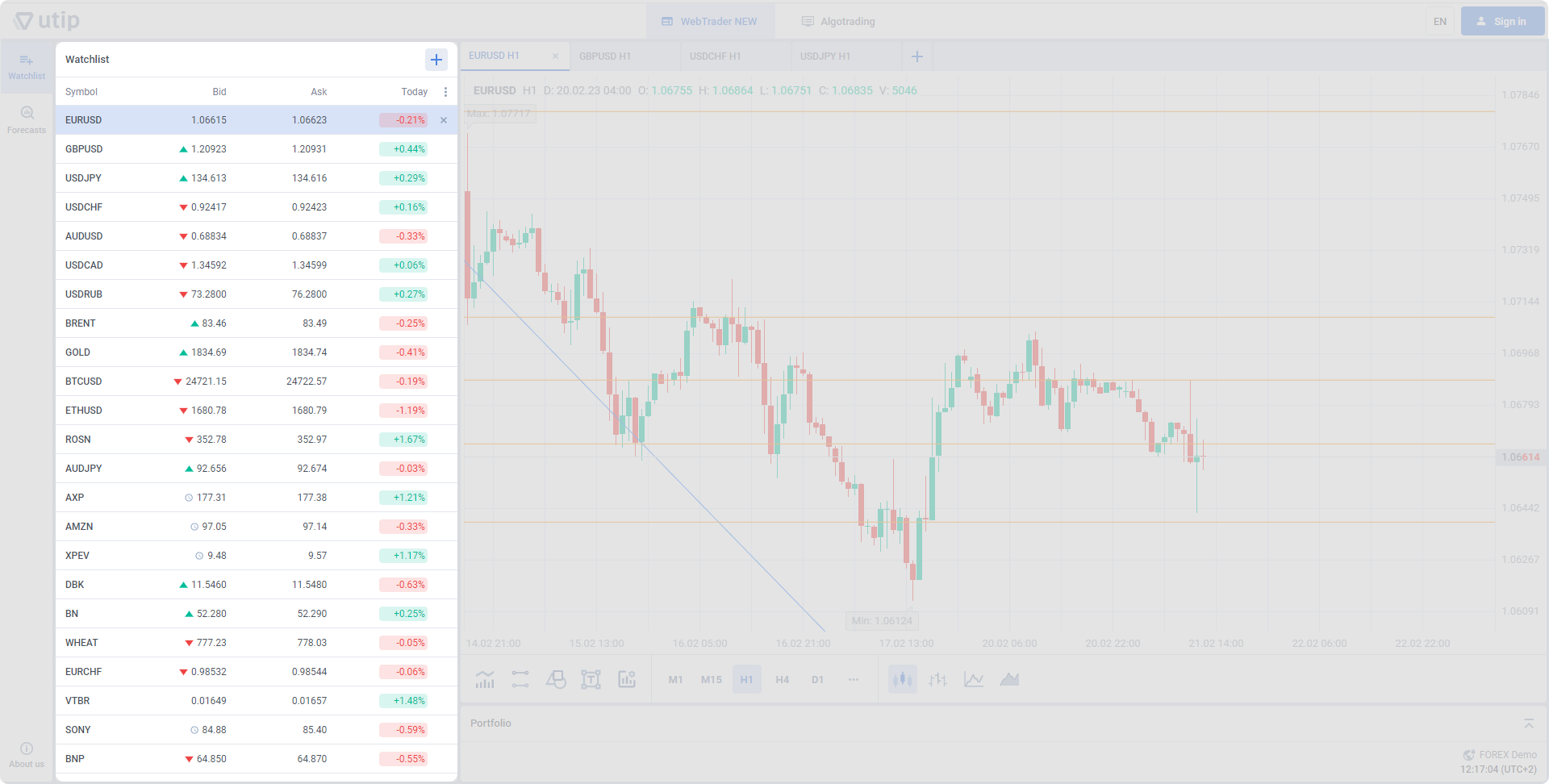

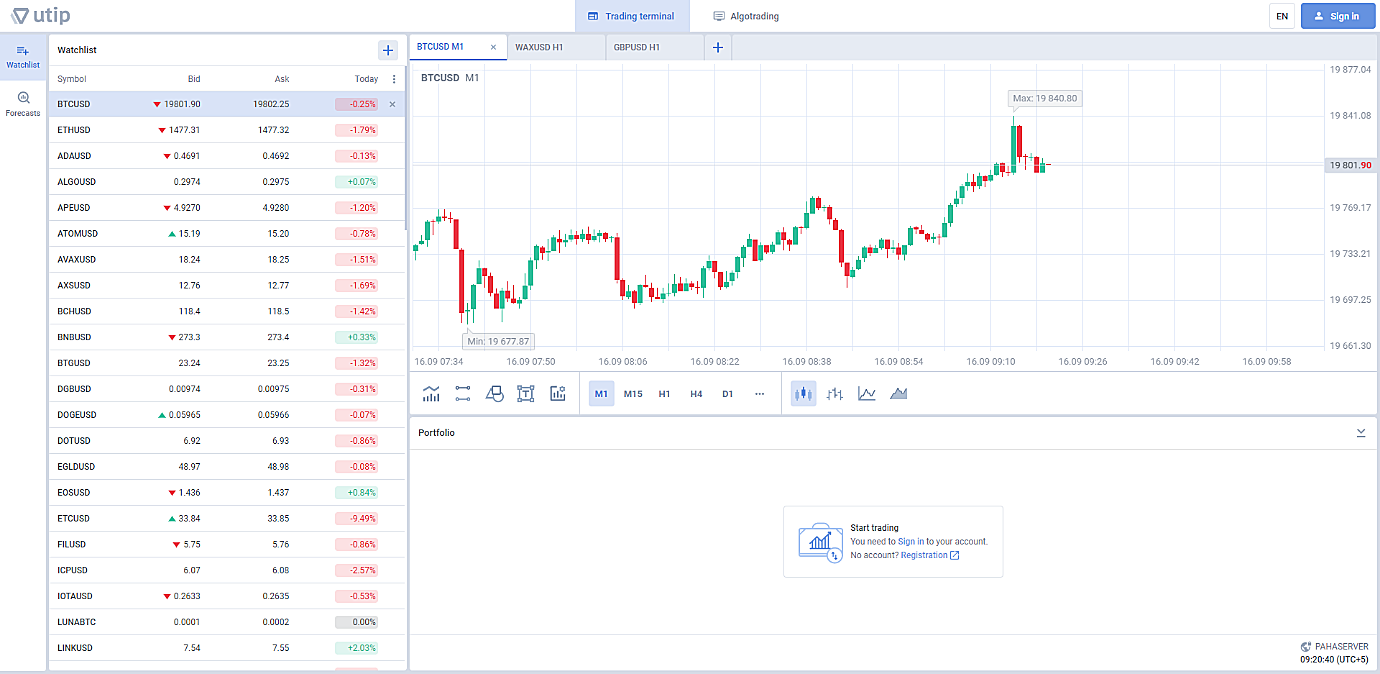

In early 2023, UTIP Technologies Ltd. launched WebTrader New, a groundbreaking software platform that outperforms other versions in multiple aspects. The terminal comes with a wide range of analytical tools, extended chart functionality, and fast operation processing.

WebTrader New is a user-friendly solution. This article focuses on the platform’s benefits and features it provides for market players.

Unauthorized terminal launch

To access UTIP WebTrader New, no authorization is required. All features (except for trading operations) are available in a demo version of the product.

This allows newcomers to explore the interface, functionality and capabilities of UTIP WebTrader New. Therefore, a user can get acquainted with the platform before making a decision to sign up and start real trading.

Unauthorized access also helps customers to reduce terminal start-up time if no trading is expected.

Convenient symbol management and customizable data display

Each symbol in the “Favorites” section has a price change indicator for a specific period. Modifications made within a day are displayed by default. A user can also configure weekly and monthly changes to be shown.

When the platform is launched for the first time, it displays a set of the most popular symbols on the chart. Brokers can select them at their discretion. Traders are free to add new symbols, remove existing ones, and sort them in a preferred order. The list does not need to be recalled each time a new symbol is added — it closes automatically when the user finishes editing it, i.e. all symbols are sorted by groups, and the ones that have been added are marked as separate items.

Extended chart functionality

WebTrader New offers an advanced chart library, making it possible to quickly download and render the archive of quotes using flexible settings. This makes shifting of the chart and its objects seamless for the user.

Chart objects. The list of drawing, commenting, and technical analysis objects has been expanded with multiple tools. Now their handling is more convenient. The chart panel contains menu call buttons with lines, drawings and comments. This window also displays objects that have already been added to the chart, so you can hide them, change their settings, or delete them.

A block “Widgets” is presented in the chart parameters. Here you can change the object color and monitor its minimum and maximum price. Volume indicators and lines can assist a trader in placing the elements of technical analysis on the chart.

Indicators. The new chart library has also been enhanced with indicators. A button to call their menu is located on the panel below the chart. In the “Add” window all indicators are grouped as it was done in the previous version. However, a search line has been added to provide quick access to the desired symbol. The window also displays a list of indicators that have been recently added to the chart. A data line with settings and action buttons for each indicator is now available in this area. Thus, you can open the settings window, hide or delete the indicator directly from the chart frame.

Chart management. Besides drawing and commenting objects, a panel below the chart provides basic controls: a list of the most popular timeframes, quick setup of the chart style, and call-up window with other settings.

Chart trading. An option to trade on the chart appeared in the previous version of the terminal. But the new platform has been modified to support market position markers and pending order levels. Operating procedures when placing and moving orders have become intuitive. So, when the market position marker is highlighted, all relevant information is displayed, including transaction type, position volume and current profit. In addition, there is a button to change position, or order parameters, as well as their quick close button right on the chart.

As with the previous version, it is possible to open several charts at the same time, but a new feature to arrange them in the right order has been added. Extensive color and style personalization options make it easier for a trader to create different displays for analysis, even on the same symbol.

Streamlined trading experience

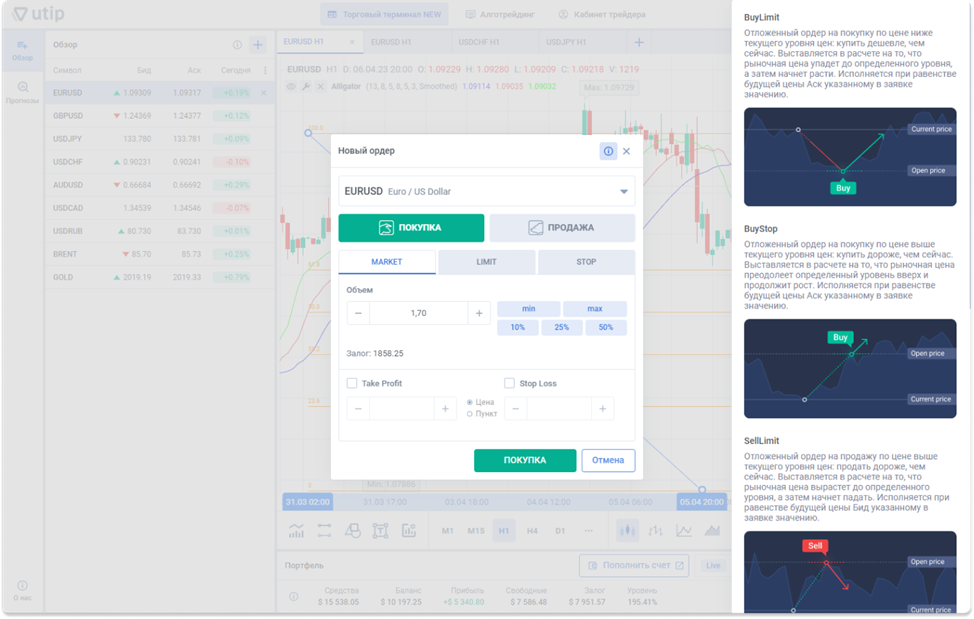

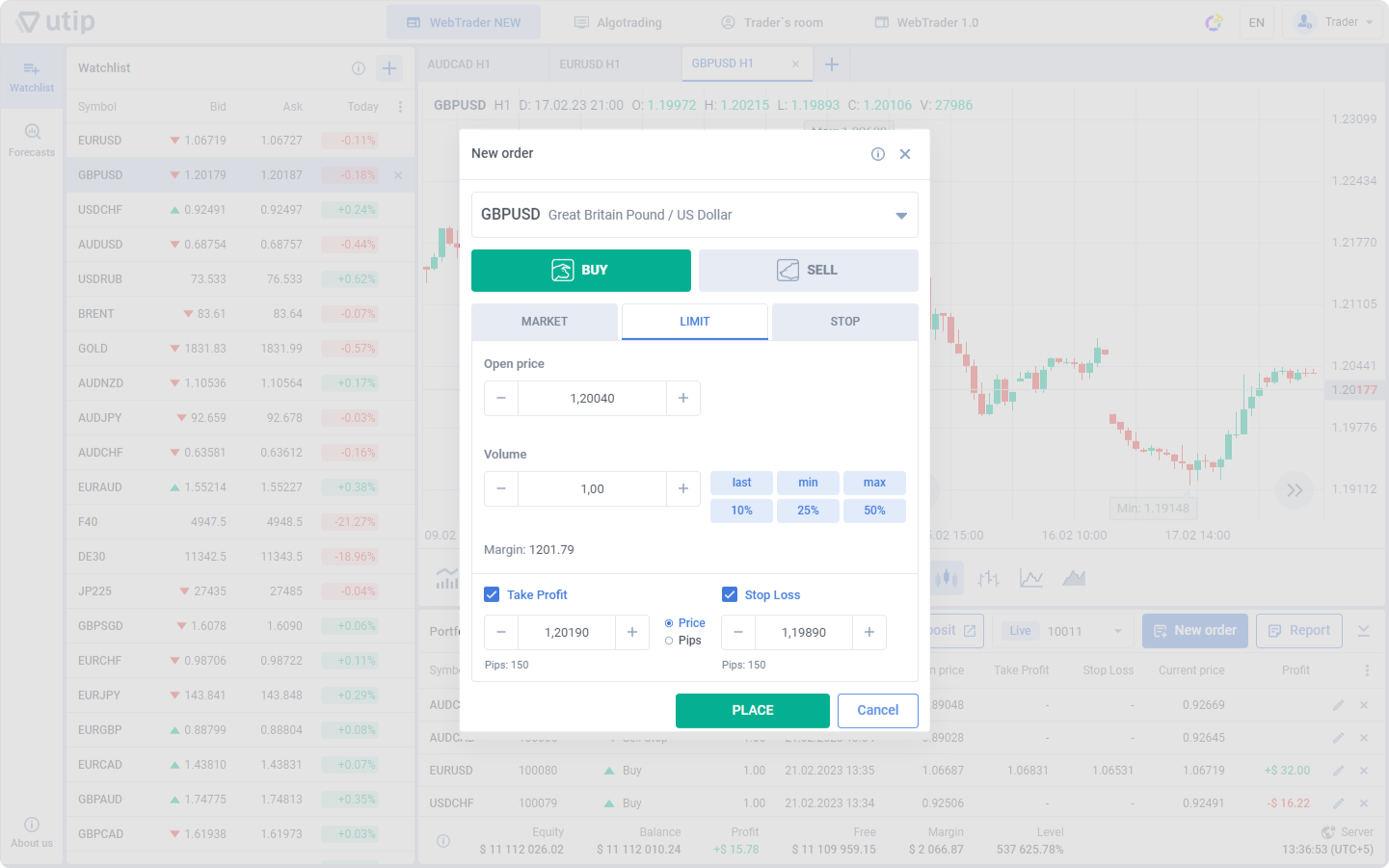

WebTrader New is the most sophisticated, up-to-date and popular solution for trading — all order types are located in the same window. To automatically calculate the pending order execution price and stop order price levels, a user should select the transaction type. Presets have also been introduced to estimate open position volume based on the trader’s available funds: a percentage of free assets, their maximum or minimum size, and the amount of the preceding deal. These settings allow the user to calculate the percentage of deposit risk in no time.

Therefore, working with the trading module has become much easier. Now opening a market position or placing a pending order takes just three or four clicks. All you need to do is to press the “New Order” button and select parameters such as transaction direction, order type and position volume.

Whether the user is an experienced trader, or a newcomer to the Forex market, getting the hang of the UTIP Technologies Ltd. trading platform is easy thanks to the built-in help.

WebTrader New offers a wide range of functional advantages, including integration with the MarketCheese analytical service. It comes with the “Market forecast” section, enabling traders to share their experience and discuss strategies with their peers. The service also has the economic calendar, which is an essential attribute of every modern trading terminal.

Small details make a product user-friendly, and that’s what the new trading terminal from UTIP Technologies Ltd. — WebTrader New — has been focused on.

This overview couldn’t cover all the benefits of the platform, but you can appreciate them on your own on WebTrader New.

According to the UTIP Studio research, having a simple sign-up form on a broker’s website can increase the conversion of leads by 150%. On the contrary, complex login procedures with numerous fields and complicated displays might confuse your potential customers.

In order to get more registrations on the trading platform, follow the tips presented by the UTIP company below.

1. Minimize a number of fields in the form

A trading account opening form should contain a minimum number of fields: username, phone number, email and password. You can reduce this number, if the trading platform’s functionality allows you to do so. Website visitors are usually intimidated by complex and incomprehensible electronic forms. That’s why limiting these fields can be a great way to reach a prospective client. Odds that the user will complete and submit a form are quite good.

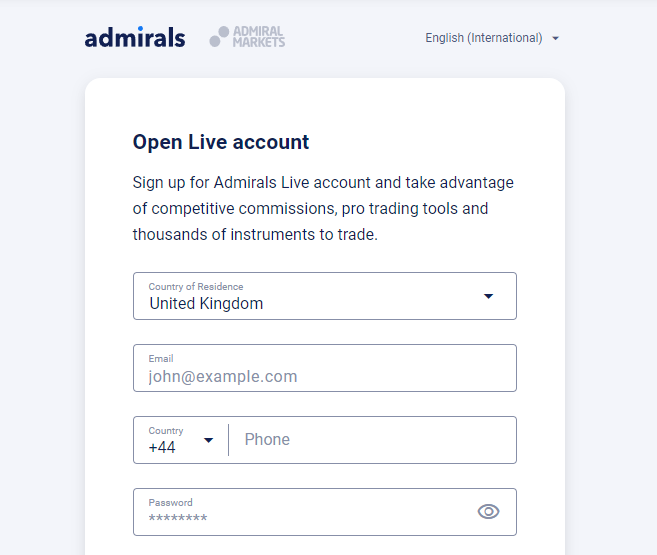

The Admirals’ sign-up form has only four fields that must be filled in

If there is a CRM system, analytical service, or any other platform that requires a significant number of fields to be completed, ask a website developer to create a multi-step form. For example, step #1 might be submitting a phone number, while step #2 can be entering a name and email, etc. Therefore, the main task, with a user filling in all the necessary data, will be accomplished. Once a person decides to make this easy step, one usually goes all the way to the end.

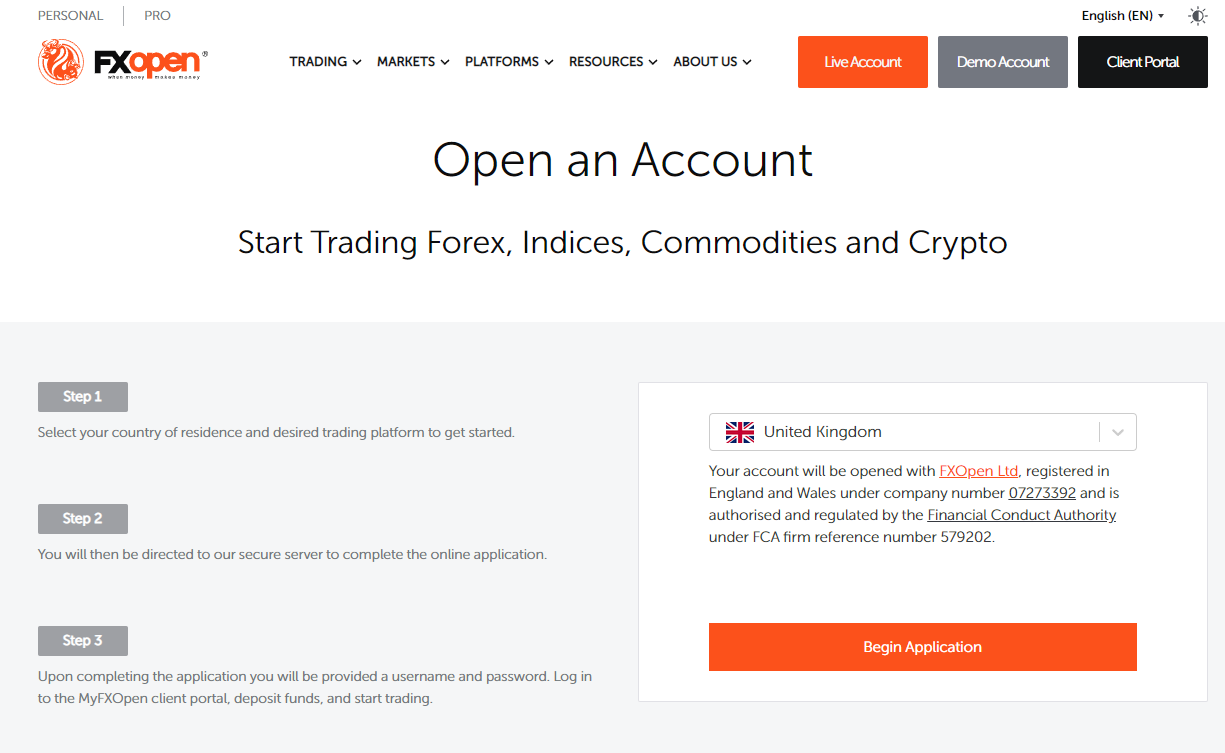

A step-by-step registration form on the FXOpen website

2. Make a user-friendly interface of the sign-up page

When it comes to creating a trading account, you should try to minimize the design effects on the sign-up page. The easier the registration form looks, the better it would be for the website owner. There is no need to deflect a visitor’s attention by using advertising banners, corporate information, or widgets.

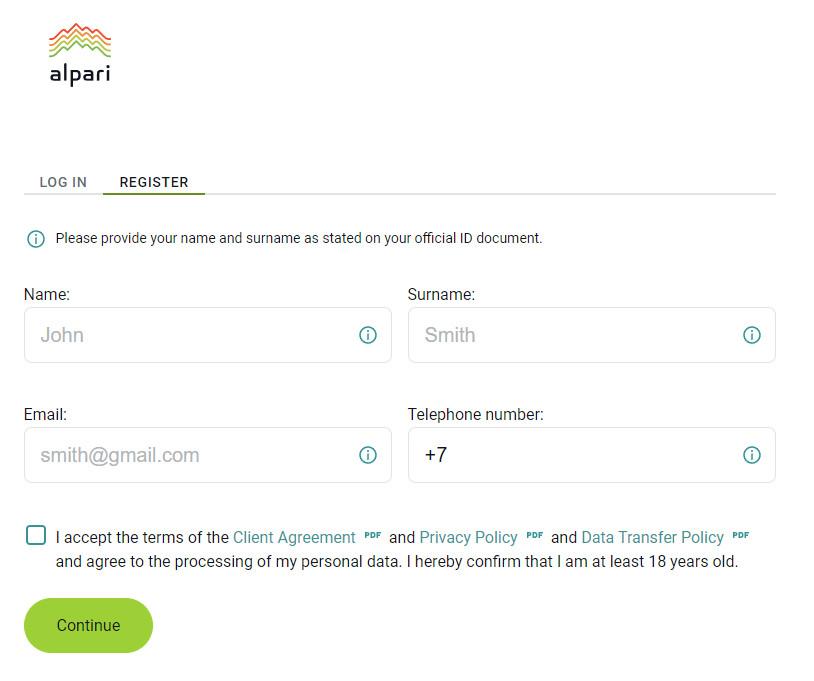

Take a look at the minimalistic design of the login page on the Alpari website

3. Provide assistance on every move

It’s a great idea to help users, if there is any difficulty with the account registration. Some people are in a hurry to fill in the fields and do it incorrectly. One way to solve the problem is to provide short hints in the form. Whenever a request is rejected, a customer will see special pop-up windows that explain how to proceed. So, no help desk staff is being involved.

If the issue cannot be addressed in a standard way, visitors should reach out to the technical support team. Place their contact information next to the form. However, the best solution might be giving a right to the help desk staff to register trading accounts in the event of a website failure. In this way, you will increase your lead conversion.

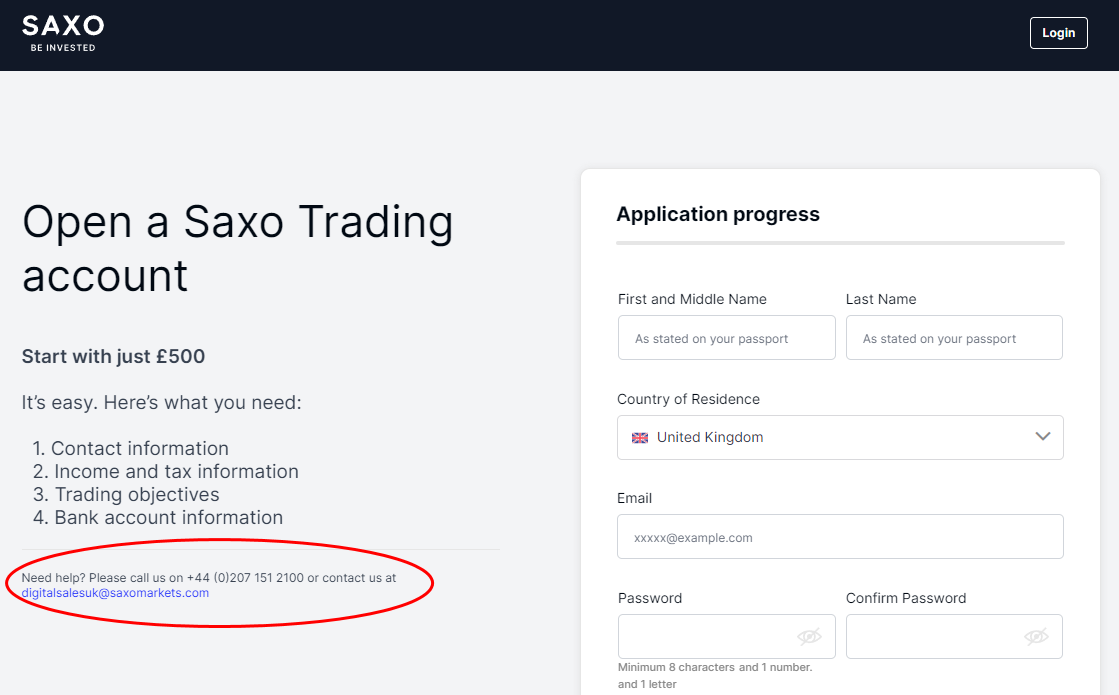

Register a trading account with Saxo: technical support contact information is given next to the form

4. Create the button “Open an account” to attract new customers

Website visitors have to navigate through the account opening page. Place the button “Open an account” next to the elements of the most frequent user interaction.

Here are some examples of how to place this button on the broker’s website:

- Install it on the first level of the home page.

- Allocate the “Open an account” button on the page with trading analytics, near the financial widget section.

- Insert the button on the page that displays information about the trading platform and the company’s contract specifications.

- Place it on the advertising banner located on the sub-pages of the website.

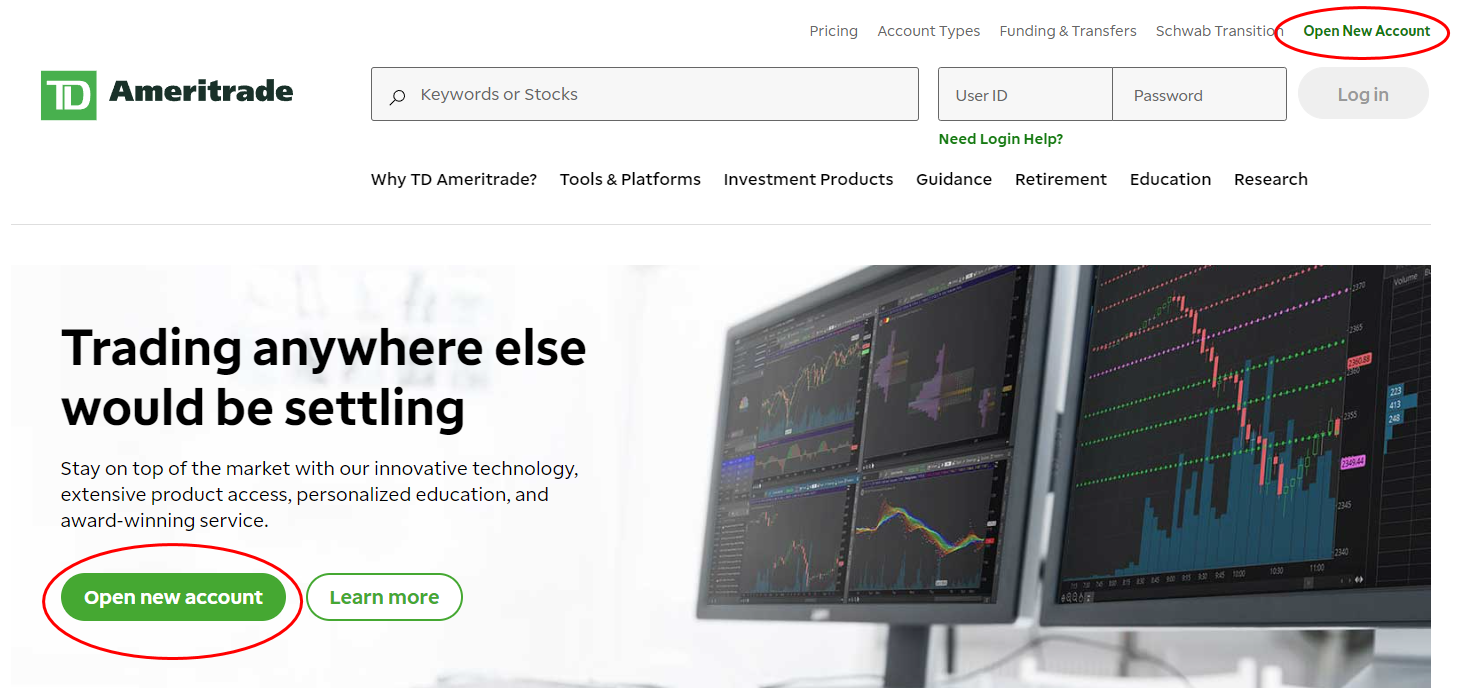

The account opening buttons on the Ameritrade home page

Buttons for opening an account should be bright. Other keys are better to be neutral in color. This method prevents clients from being distracted. Their labels must imply a specific action, for example, “Open an account”, “Sign up”, “Start trading”, “Start making profit”, etc.

In fact, buttons placed at the top of the website or next to the financial widget section generate more clicks. That’s where the MarketCheese economic calendar with a built-in “Open an account” button comes into play. This option can be installed on your website, providing important news feeds for both first-time investors and professional market participants. Placing this widget on the broker’s website is a great way to attract more traders and increase your lead conversion.

The MarketCheese economic calendar

5. Ensure the form being integrated with a CRM-system

If the sign-up form is not compatible with the CRM-system, you will probably lose leads. This is especially true for brokers who attract high volumes of traffic to their websites. Connecting a CRM-system to the trading account sign-up form enables incoming leads to be delivered automatically to the client base.

Make sure to use a CRM-system adapted for fintech business. One can get it from their trading platform developer. For instance, UTIP provides access to this system for all clients by default. In addition, our team is able to integrate the UTIP CRM into customer websites for free. Therefore, the company’s clients are able to focus on their business instead of implementing complex technical solutions on their own.

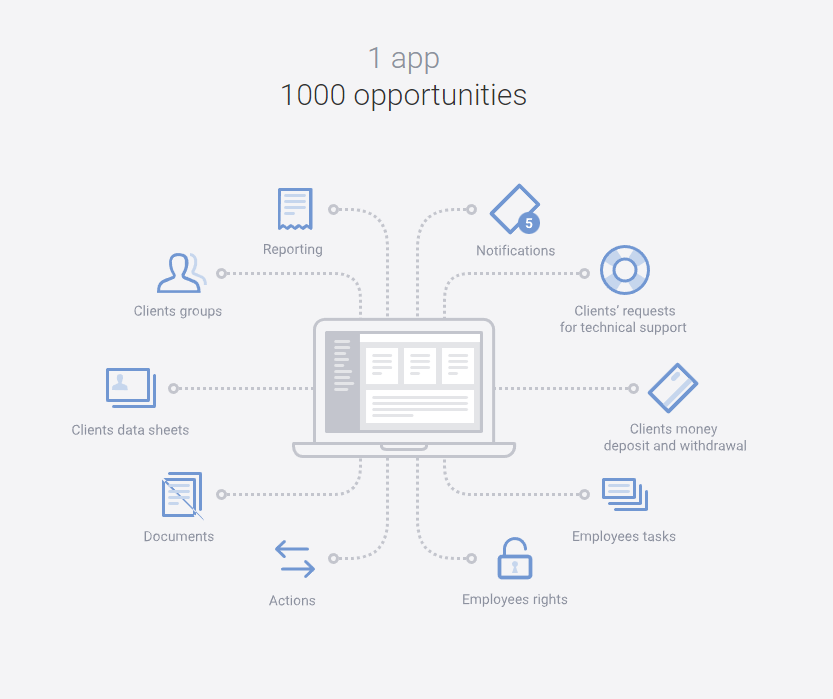

The UTIP CRM meets major customer service challenges faced by a broker

To find out more about website development for Forex brokers, contact the UTIP Studio design team, or leave a comment below.

Financial operation management tools are an integral part of any brokerage activity in the Forex market. These tools have already proved to be effective for market players, making business processes streamlined.

The present article covers the basic functions of financial operation management implemented in one system — the UTIP CRM.

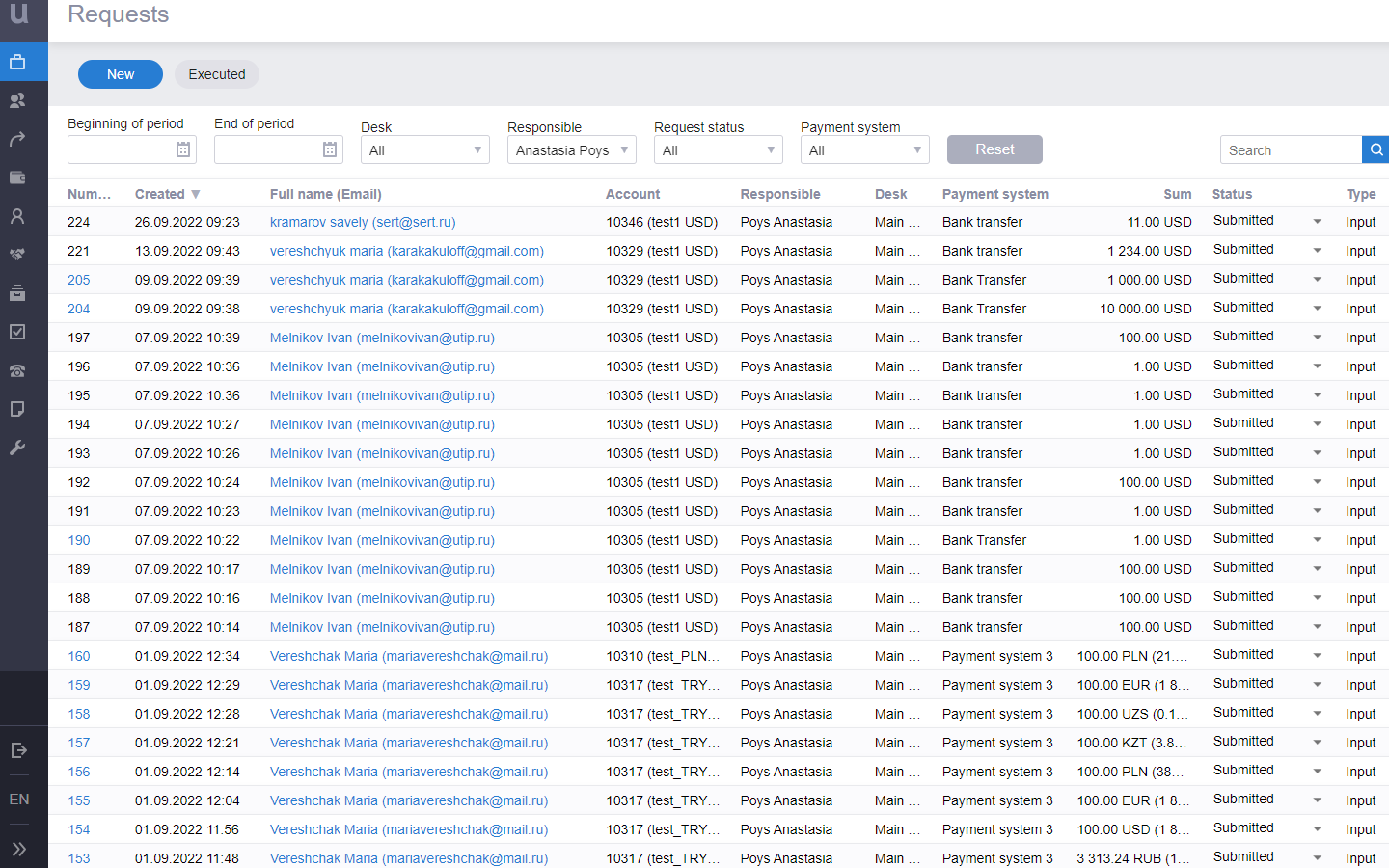

Requests as a main element of deposit operation management

Automatic verification helps to manage requests promptly, minimizes the risk of human errors and contributes to the trader’s positive experience.

The «Requests» table displays all the client requests for depositing and withdrawing in one place. This provides quick access to them, while filters make the search easier. The table shows the key information about the request, thereby passing over the necessity to open it in a full-fledged mode.

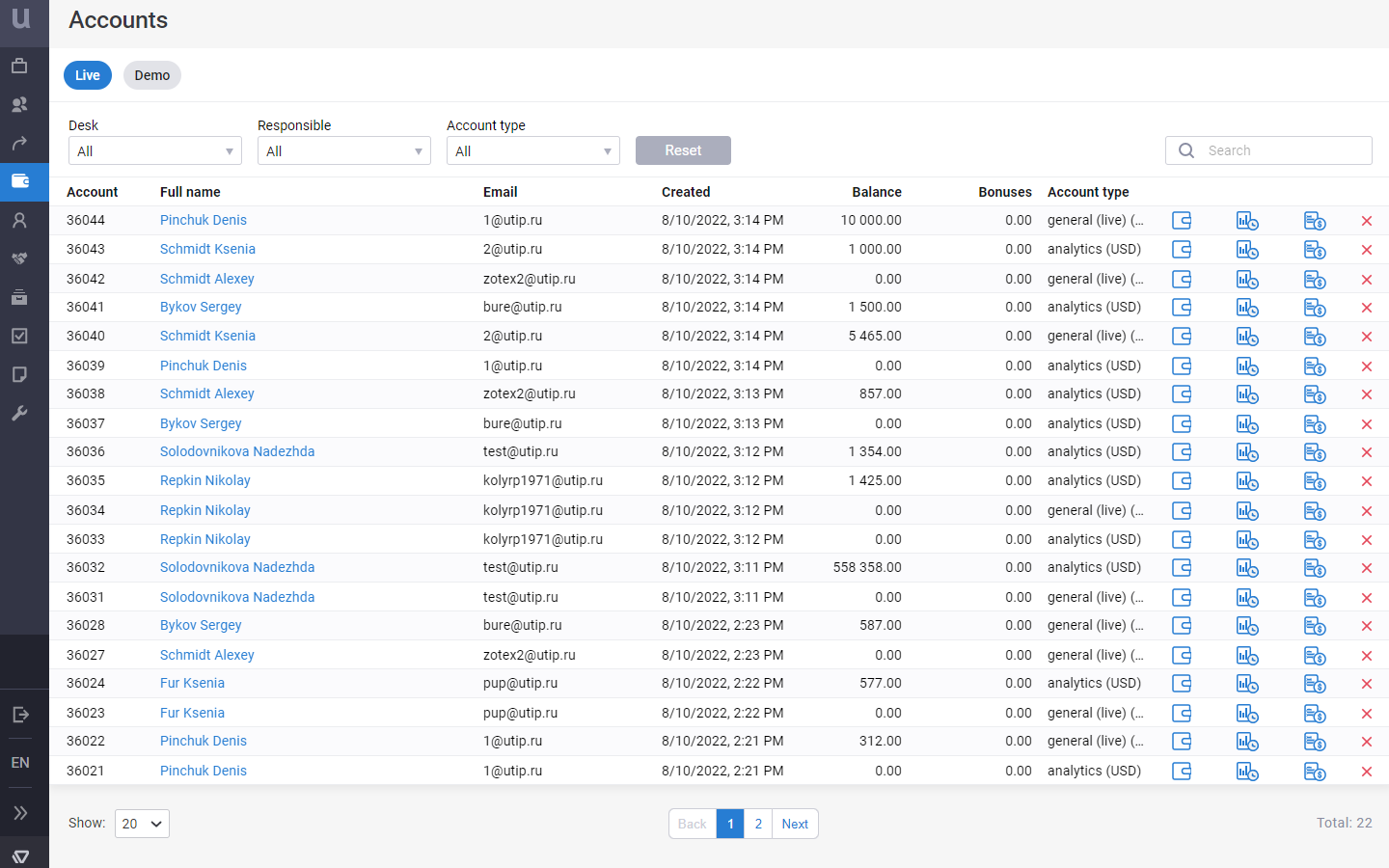

Working with traders’ accounts in the UTIP CRM

The UTIP CRM has integrated all important features that simplify the trader’s path from creating an account to making the first deposit and stepping up to live trading.

Using the UTIP CRM, employees are able to carry out various operations with traders’ accounts in one system, i.e. creating, editing, or deleting, along with depositing and withdrawing funds.

In addition, the client card contains detailed information on the trader’s accounts and deposits, where the employee has a right to make alterations if necessary.

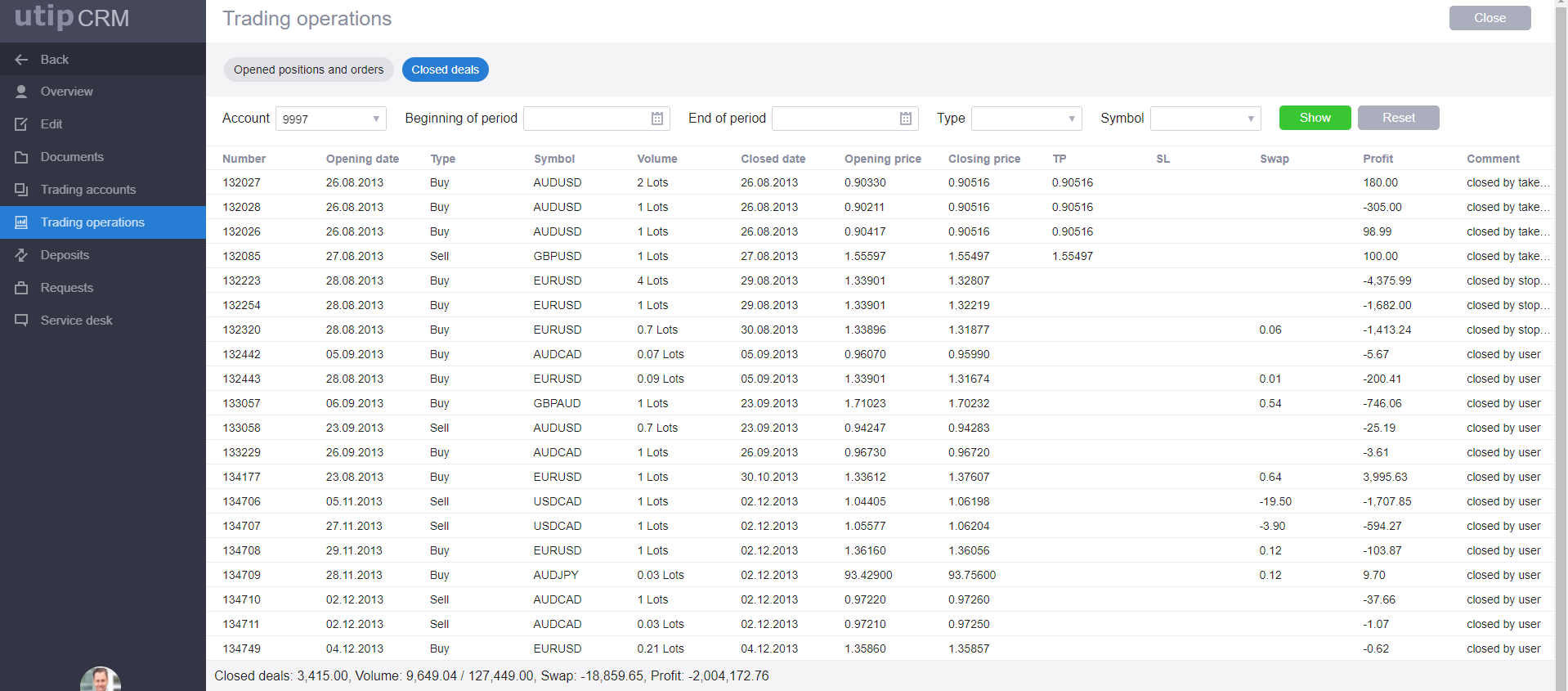

One place for trading operations

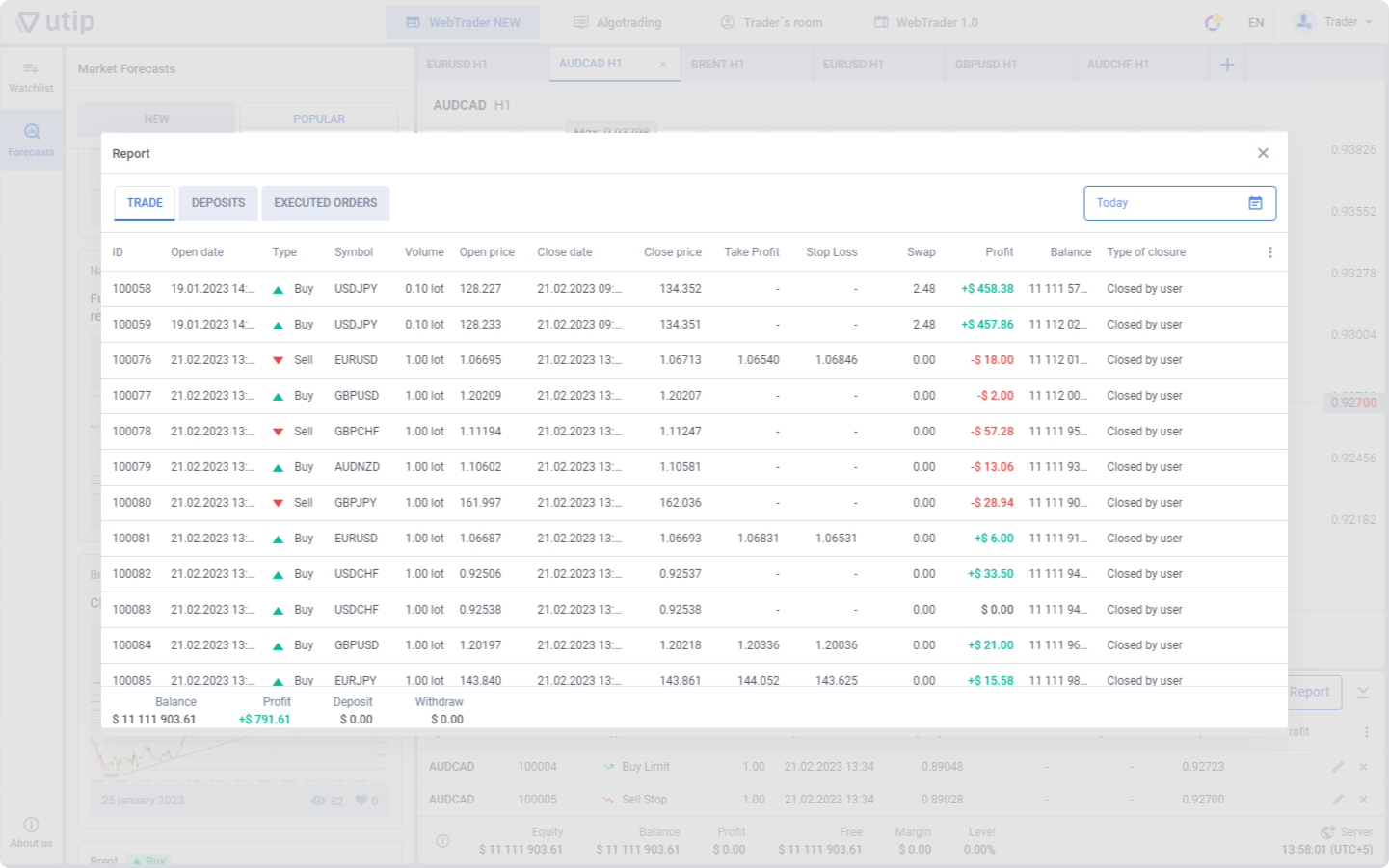

Each client card has a «Trading operations» section for viewing the history of deals, open positions and orders made by the market participant in real time.

All the necessary data showing the trader’s open positions is located at the bottom of the table.

Reports on trading accounts